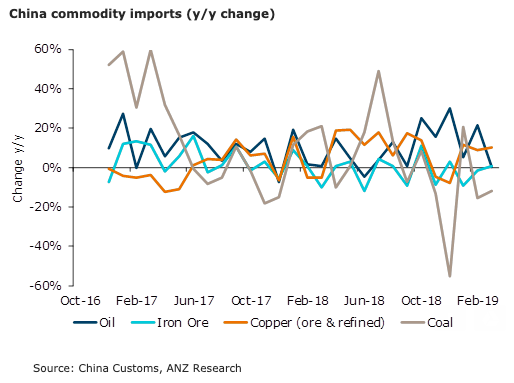

China’s commodities imports recorded solid gains in March on an upswing in seasonal demand. This validates the recent improvement in industrial activities and bodes well for imports in coming months amid rising fixed asset investment and policy measures to support retail spending.

Crude oil imports were steady despite maintenance related closures in key refineries. Oil imports in Q1 increased strongly as lower oil prices encouraged refineries to replenish their depleted stocks. Natural gas imports remained at elevated levels, with low prices likely to have supported demand.

Demand for copper remained strong. Imports of copper concentrate rose 24.9 percent y/y to 1.8mt. When combined with primary copper and products, total imports of copper was up 12.4 percent y/y. This should dispel any myths that copper demand has been soft in China post the Chinese New Year holidays, ANZ Research reported

Iron ore imports rebounded month on month, as steel mills restocked in light of disruptions to Brazilian output. Coal imports rebounded from February but remained weak on a seasonal basis as import restrictions continued to impact trade.

Meanwhile, soybeans imports were weaker than expected. Imports are seen increasing in the coming months as demand picks up from the hog industry, the report added.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality