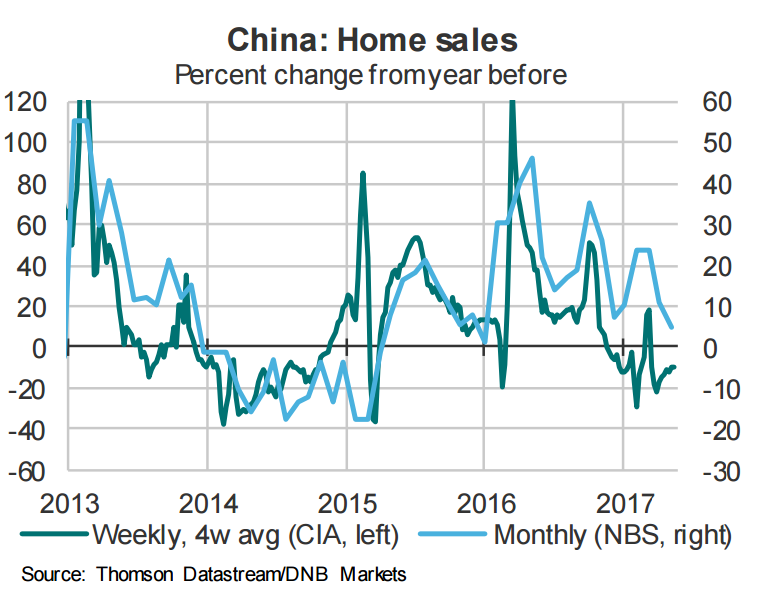

Latest data released by China Index Academy showed that a total 51,000 units were reported as sold for 30 T1 and T2 for week 20, down from 59,000 units in the corresponding week last year. China's home sales declined 13 percent y/y, consistent with that seen earlier this year. China's home sales till date this year stood at 945,000 units, down from 1,057,000 units in the same period last year, down 10.5 percent y/y.

Tough regulations imposed by Chinese regulators with restrictions on home purchases to prevent speculation in the housing market have seems to be working. That said, regional divergences seem to be rising. Sales in north-western cities rose by around 25 percent y/y, while sales in southeastern cities are fell by around 25 percent y/y.

Despite the decline in home sales, the rate of decline seems to be stabilizing around -10 percent. Due to large differences between regions, it seems likely that regulation will become stricter on a broader basis. The upshot is that analysts expect national sales growth to still likely to head into negative territory relatively soon, which should lead way for a moderate slowdown in housing starts in H2 this year.

"Monetary policy should be tightened further. We expect a couple of more hikes in the PBoC 7d repo rate this year," said DNB Markets in a report to clients.

Data released on Wednesday showed that growth in activity at China’s manufacturers was unchanged in May, with the official PMI remaining at the lowest level since September (51.2), but defying expectations of a drop to 51.0. The non-manufacturing PMI rose from 54 to 54.5. Meanwhile, the commodity price, led by iron ore, remained generally soft, suggesting that the investment growth is likely to moderate in the next couple of quarters.

While the PMI seems to point to some sort of stability, the activity indicators in April had already illustrated significantly slowing momentum. China needs to strike a balance between growth, debt and leveraging. The rising debt is the major concern for the economy, which also triggered Moody's downgrade on China recently.

"The deleveraging will continue to dominate the policy stance at this conjunction; therefore overall liquidity conditions will remain tight in both onshore CNY and offshore CNH markets," said Commerzbank in a report.

Chinese yuan strengthened on robust manufacturing PMI data. USD/CNY made intraday high at 6.8526 and low at 6.8169 levels. PBOC set yuan mid-point at 6.8633/ dlr vs last close 6.8525. A close below 6.85 will drag the pair lower. We prefer to take short position in USD/CNY around 6.85, stop loss 6.8710 and target of 6.8090.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock