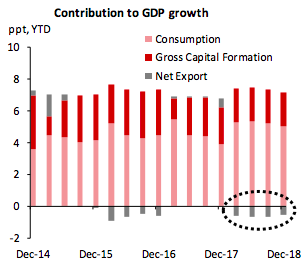

China’s real GDP growth fell further to 6.4 percent y/y in 4Q18 from 6.5 percent in 3Q18 as expected. Net export continued to drag the overall performance for the fourth straight quarter in spite of slumping oil price.

This largely mirrored the negative export growth in December after front-loading activities ended. The monthly data pointed to a grim outlook for 1Q19. Retail sales inched up to 8.2 percent y/y in December from 8.1 percent in November, staying at the lowest range since 1999.

Expenditure on most other discretionary goods such as cosmetics, jewellery, and automobile remained weak. Obviously, consumer confidence has been sapped by job insecurity and slower wage growth.

Fading credit impulse on the back of regulation tightening points to further weakness ahead. Infrastructure investment was a bright spot; growth was positive for a second consecutive month (5.7 percent in December vs 2.5 percent in November (3mma)).

The National Development and Reform Commission (NDRC) greenlighted RMB1.2 billion worth of infrastructure projects in 4Q18, the highest in three years.

"We expect the quota of special bond issuance (excluded from official budgets) to increase to RMB2 trillion in 2019 from RMB1.35 trillion last year. Off-budget expansions will likely include the re-launching of special construction fund," DBS Research commented.

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off