Speculations have been running high that Chinese authorities, which are popularly called as the "National Team" are without funds or they might have to liquidate their positions.

A research from Goldman Sachs poured cold water over those speculation. The research showed that the "national team" still have enough firepower left and maybe waiting for the right moment to strike in. Chinese authorities have used about $144 billion funds since June from its war chest of $322 billion.

This means Chinese stock market will see further intervention from the government side and possibility of success still holds.

However it reveals a fragility that the Chinese market, which has shedded about 1/3rd of the valuation since its peak is increasingly getting addicted to moves from the government. It makes the market vulnerable in the long term.

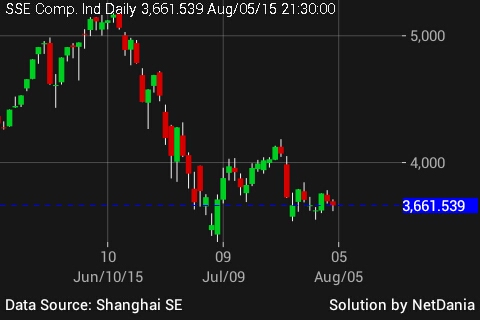

Chinese benchmark stock index, Shanghai composite closed down by -0.9% today, making it the second consecutive decline.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand