Today's devaluation of Chinese currency is likely to have far-fetched impact over global trade and is likely to intensify the ongoing currency war in Asia.

- At one hand Bank of Japan (BOJ) is pursuing monetary policy that is devaluing Yen due to heavy increase in monetary base. Since 2012, Yen has depreciated more than 40% against Dollar.

- On the other, South Korean central bank has been trying to keep its exports competitive enough by keeping rates at record low.

- Though these two have been major players in the war, countries like Singapore has also pursued loose monetary policy in a bid to keep Sing Dollar competitive enough.

- Indian central bank has provided three aggressive rate cuts and prevented Indian Rupee from appreciated, in spite of heavy inflow of portfolio funds and direct investments.

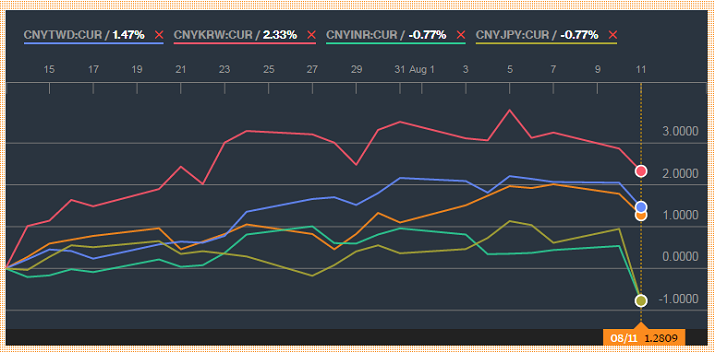

Now, China, Asia's largest economy has joined in to make its exports competitive enough amid slowdown and weak Euro and Yen.

As a result, Asian currencies are down heavily against Dollar, with Yuan leading the way.

- Offshore Yuan is down about 2.68%, followed by South Korean Won (-1.77%), Taiwan Dollar (-1.6%), Singapore Dollar (-1.1%), Indian Rupee (-0.7%) and Yen (-0.21%).

These currencies have high sensitivity to both rate hike from US Federal Reserve as well as fundamental outlook of China. While rate hike from US is likely to pose challenge through portfolio outflow, weaker Yen would exert additional pressure over trade competitiveness as well as revenue from exports to China.

Though all the above mentioned currencies are at risk over FED hike and weaker Yuan, Korean Won (KRW), Taiwan Dollar (TWD) and Singapore Dollar (SGD) faces higher risk over the near to medium term.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate