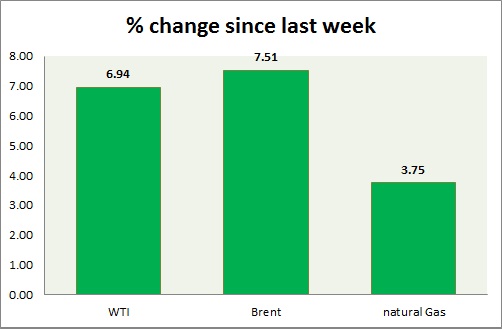

Energy segment's performance is mixed in today's trading. Weekly performance at a glance in chart & table -

- Oil (WTI) - WTI rallied back after dollar weakened post FOMC last week. WTI crude is currently trading at 46.90, up 0.92% today. Immediate support lies at 42, 38 and resistance at 48.3, 53.

- Oil (Brent) - Demand concern from china weighs on price as Brent suffers in spreads. Brent-WTI spread is trading at $ 8.76/barrel, support lies at $8 and resistance at $13. Last week it traded close to $11.5/barrel. Brent bounced back after reaching initial target of $53. Immediate support lies at 52.5, 48, 45 & resistance at 58.4, 62.

- Natural Gas - Natural gas failed to gain traction over weaker FOMC as improved weather condition continue to weigh on prices. Last week's inventory fell only by 45 billion cubic feet. Natural Gas is currently trading at 2.70/mmbtu. Immediate support lies at 2.65 & resistance at 2.87, 3.02.

|

WTI |

0.92% |

|

Brent |

0.65% |

|

Natural Gas |

-3.02% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate