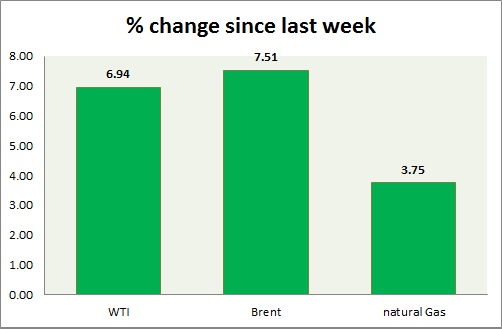

Energy segment is once again hit by selling at key levels. Weekly performance at a glance in chart & table

- Oil (WTI) - WTI fell today by more than 2% as tensions in Middle East failed to gain traction. Price has reached 1st target of $51/barrel and looks like will go down for now before testing the upper bound of current range at $54. Target to the downside is around $45. Immediate support lies at 47.5-47, 44-43.7 and resistance at 51.7-52.1, 54-54.5, 58.7-59.2.

- Oil (Brent) - Brent fell similar to WTI. Brent-WTI spread narrowed after yesterday's gain, trading at $ 7.7/barrel, might go further down if situation subsides. Last week it traded close to $11.5/barrel. Brent is trading at $57.7/barrel, down 1.8% today. Any impulsive upside would remain capped around $61/barrel. Immediate support lies at 56.7-56.3, 53 & resistance at 62.6-63.4.

- Natural Gas - Natural gas is the worst performer this week. Performance was weak after latest report from EIA showed inventory expanded by 12 billion cubic feet, as it stopped decline. Price pattern suggests that prices might drop down towards $2.44/mmbtu. Approaching summer is weighing on price. Natural Gas is currently trading at 2.64/mmbtu, down 0.75% today. Immediate support lies at 2.65, 2.55 & resistance at 2.74, 2.91, and 3.02.

|

WTI |

7.52% |

|

Brent |

4.54% |

|

Natural Gas |

-5.17% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary