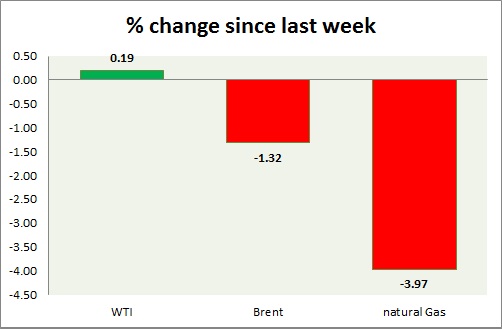

Energy segment has rebounded sharply since yesterday. Weekly performance at a glance in chart & table

Oil (WTI) -

- WTI is giving up gains after last week's commendable rise. China's reserve ratio cut only provided temporary boost. However further rise in prices are expected despite drop in prices.

- Bulls might push prices higher towards $60 as initial target area and move on to test $63-65/barrel resistance area.

- WTI is currently trading at $56.9/barrel. Immediate support lies at $51.2-50, $47.5-47 and resistance at $58.9-59.7.

Oil (Brent) -

- Brent dropped after early gains over Chinese policy ease. Price traded as high as $64.3/barrel, trading at 62.9/barrel. Price might comeback to test $60 level, before heading higher.

- Brent-WTI spread moved lost grounds today, currently trading at $6/barrel. Bears are back in control, however conviction lacking.

- Brent is trading at $62.9/barrel. Immediate support lies at 61.8-61.4, $58-57 area and resistance at $ 62.6-64 region.

Natural Gas -

- Natural gas is worst performer today, bulls were halted near $2.7/mmbtu last week. Rally over weaker dollar ended. Bears would now push prices lower.

- Natural Gas is currently trading at 2.55/mmbtu. Immediate support lies at $2.12 area & resistance at $2.71.

|

WTI |

+0.19% |

|

Brent |

+1.32% |

|

Natural Gas |

-3.97% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate