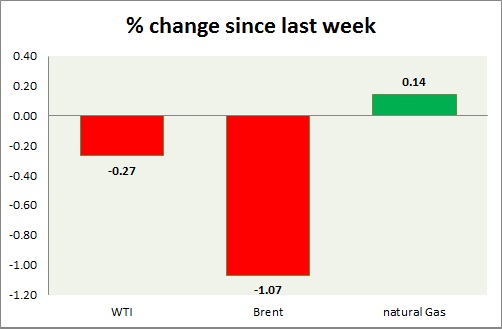

Energy segment is trading in red today. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI bulls are struggling since last week after days of advance.

- WTI carved bearish doji in weekly chart. Further downside remains open. RSI is also around 50 level resistance.

- WTI is currently trading at $59.2/barrel. Immediate support lies at $55-54.6, $51.2-50 and resistance at $63-$65. $58 may continue to provide some interim support.

Oil (Brent) -

- Brent rally soured last week with price carving very bearish gravestone doji in daily chart.

- Brent-WTI spread dropped further around 50 cents, currently trading at $5.6/barrel.

- Brent is trading at $64.7/barrel. Immediate support lies at $63.7-63.2, 61.8-61.4 area and resistance at $ 70 region.

Natural Gas -

- Natural gas has broken above resistance area however price is down over profit booking today.

- Downside bias has diminished significantly. Buy trades might be entered with small quantity.

- US department of Energy is allowing partial export of natural gas.

- However bulls seem to be strong and will push prices towards $3.5/mmbtu, should $2.45 holds. Immediate support is around $2.65 for the buy trade. Key resistance is at 3.04-3.12 area.

- Natural Gas is currently trading at 2.84/mmbtu. Immediate support lies at $2.65, $2.44 area & resistance at $2.86.

|

WTI |

-0.27% |

|

Brent |

-1.07% |

|

Natural Gas |

+0.14% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?