Energy pack is trading in green today. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI has bounced back from $56.7 as crude stock surprisingly decreased for fourth consecutive week.

- WTI still remains vulnerable but might challenge the dojis.

- Target for the downside is coming around $50-51/barrel if doji high is not taken out at $62.7.

- WTI is currently trading at $59.1/barrel. Immediate support lies at $55-54.6, $51.2-50 and resistance at $63-$65.

Oil (Brent) -

- Brent has moved higher similar to WTI, but better performer.

- Brent-WTI gained 60 cents today, currently trading at $5.3/barrel. Brent is at crucial support.

- Target is coming around $55/barrel, if the high is not taken out.

- Brent is trading at $64.4/barrel. Immediate support lies at 61.8-61.4 area and resistance at $ 70 region.

Natural Gas -

- Natural gas dipped further as inventory rose higher than expected.

- Price has almost reached initial target of $2.62. Partial booking is suggested before weekend close.

- Price target for bulls are coming close to $3.5/mmbtu, should support at $2.45 holds. Averaging it as low as possible would diminish risk.

- Natural Gas is currently trading at $2.65/mmbtu. Immediate support lies at $2.78, $2.68 area & resistance at $3.04, $3.32.

|

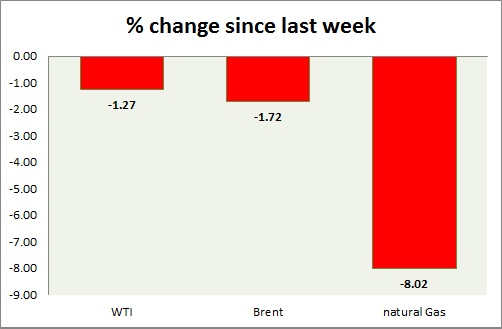

WTI |

-1.27% |

|

Brent |

-1.72% |

|

Natural Gas |

-8.02% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand