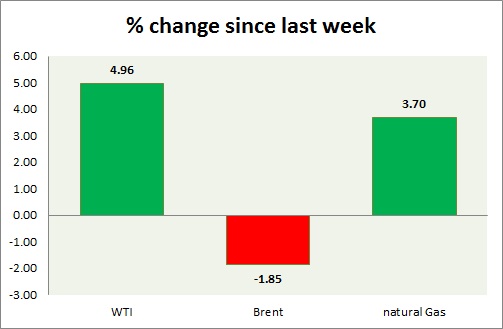

The energy segment over the last year remained the worst performer. Performance this week at a glance in chart & table -

- Oil (WTI) - Crude oil price remained depressed and continuing its whipsaw movement after last night's inventory report showed that stock built up at 8.4 million barrels were much larger than expected. WTI is currently trading at $49.4/ barrel, down 3% for the day. Immediate support lies at 48 and resistance at 54.

- Oil (Brent) - Brent remained the top performer as demand outlook improved and supply glut is now becoming more of an USA phenomenon. Brent-WTI spread has broken above $10 and currently trading close to $12. Further gain seems to be ahead. Brent is currently trading at $61.2/barrel, down 0.8% for the day. Immediate support lies at 58 & resistance at 63.

- Natural Gas - Natural gas is the worst performer in the segment and continues to decline amid higher production and lesser demand due to weather improvement. Today's inventory data showed stock drop was lower than expected at 219 billion cubic feet. Natural gas is currently trading at $ 2.72/mmbtu. Immediate support lies at 2.66 & resistance at 2.88. Prices could decline over the summer and even below $2/mmbtu.

|

WTI |

-2.87% |

|

Brent |

2.06% |

|

Natural Gas |

-7.59% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary