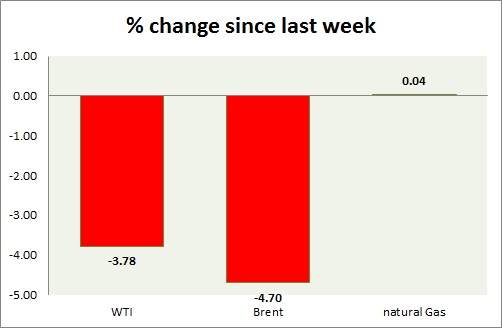

Energy pack is trading in red today. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI further dropped as 8 week range got broken to downside. Today's range $56.8-56.2

- Target for the downside is coming around $50-51/barrel, a fall towards $42 seems likely

- WTI is currently trading at $53.5/barrel. Immediate support lies at $51.2-50 and resistance at $57

Oil (Brent) -

- Brent dropped as support around $61 got cleared last week. Approaching Iran deal is weighing on price.

- Brent-WTI spread lost 90 cents today, currently trading at $4.1/barrel. Spread might rise faster if Iran deal remains eluded beyond 9th July, whereas a deal might contract the spread further.

- Target is coming around $55/barrel, and next target is around $51/barrel

- Brent is trading at $57.6/barrel. Immediate support lies at $55 area and resistance at $ 65 region.

Natural Gas -

- Natural gas found support around $2.7/mmbtu area once more, however bulls need to clear above $2.85 resistance zone for further advance.

- Natural Gas is currently trading at $2.77/mmbtu. Immediate support lies at $2.7, $2.45 area & resistance at $2.85, $2.93, $3.04, $3.32.

|

WTI |

-3.78% |

|

Brent |

-4.70% |

|

Natural Gas |

+0.04% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary