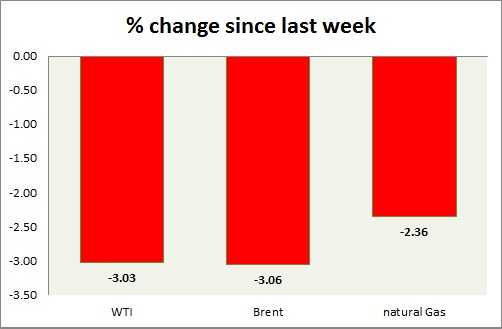

Energy pack is in red today. Weekly performance at a glance in chart & table.

Oil (WTI) -

- WTI failed attempt to gain soured as stocks rose at fastest pace since April. Today's range $46.3-43.7

- Stocks in US rose by 4.67 million barrels according to EIA and 7.6 million barrels according to API.

- WTI is currently trading at $43.9/barrel. Immediate support lies at $43.3, $41.5 area and resistance at $50 area.

Oil (Brent) -

- Brent dropped along with WTI, however relatively better performer than today. However that part soured after EIA data. Today's range - $48.3-50.8.

- Brent-WTI flat at $4.5/barrel. Further contraction possible.

- Brent is trading at $48.5/barrel. Immediate support lies at $48 area and resistance at $54.5, 59 region.

Natural Gas -

- Natural gas continues to consolidate around $2.7/mmbtu and likely to drop further, focus on inventory tomorrow. Today's range $2.70-2.645.

- Price might drop to $2.35/mmbtu, since support cleared. However $2.63 area proving to be strong support.

- Natural Gas is currently trading at $2.65/mmbtu. Immediate support lies at $2.55, $2.45 area & resistance at $2.75, $2.95, $3.04, $3.32.

WTI

+2.05%

Brent

+1.54%

Natural Gas

-1.25%

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand