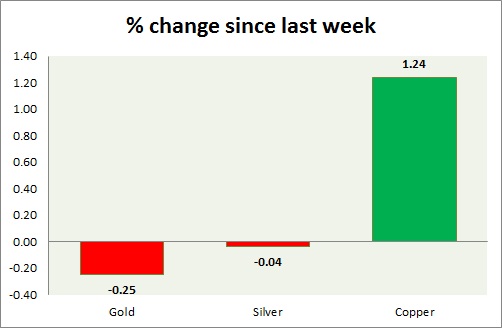

Metals' performance are positive in today's trading, however rallies continue to counter sellers at stages. Performance this week at a glance in chart & table -

Gold -

- Gold is up more than 1% as $1193 level provided support, stronger dollar continue to pose challenge.

- Gold is currently trading at $1209, up 1.22% today. Immediate support lies at $1193, $1178, $1160 and resistance at $1224 and $1236-1240 area.

Silver -

- Silver is still the worst performer this week, so far. Volatility remains large this week. Stronger dollar might push price lower, in spite of bounce back.

- Mint ratio dropped 1.15% today, currently at 72.9. Mint ratio and precious metal prices are inversely related more often than not.

- Silver is currently trading at $16.57/troy ounce, up 2.32% today. Downtrend remains intact and price might plunge lower. Support lies at 15.42,14 & resistance at 17.5-17.7.

Copper -

- Copper failed to pose comeback amid better than expected CPI from China. Immediate range remains $2.71-$2.78.

- Bears are in full control around $2.8-2.92 area. Downside target is coming around $2.52, with a stop of $2.84, upside can still be played with target around $3.1 with stop of $ 2.45.

- Bearish inverted hammer remains in play in weekly chart.

- Copper is currently trading at $2.74/pound. Immediate support lies at 2.59 & resistance at 2.83, 2.93, and 3.07.

|

Gold |

+0.75% |

|

Silver |

-0.60% |

|

Copper |

1.06% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary