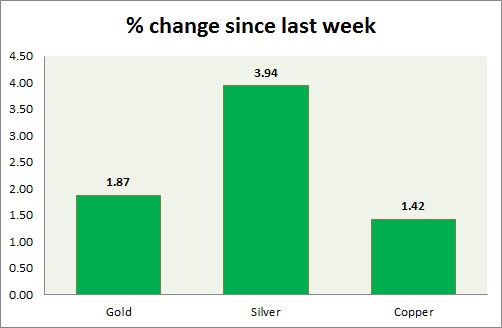

Metals are all trading in green, benefitting from weaker dollar. Performance this week at a glance in chart & table -

Gold -

- Gold bears were halted at $1178 support and price bounced back above $1200, as weaker data weakened dollar.

- Focus remains on FOMC and $1224 level. Speculators increased bullish bets by 437 million. Net at +12.17 billion.

- Gold is currently trading at $1201/troy ounce. Immediate support lies at $1178, $1160 and resistance at $1224 and $1236-1240 area.

Silver -

- Silver is the best performer today, price traded around $16.5/troy ounce after bouncing from $15.7 area. Broader bias is still downwards, however FOMC might provide fuel for further gains.

- Mint ratio is down -2.26%, currently at 73.2. Mint ratio and precious metal prices are inversely related more often than not.

- Silver is currently trading at $16.4/troy ounce, up close to 4% over last week's close. Support lies at $15.42, $14 & resistance at $16.3-$16.6, $17.5-17.7.

Copper -

- Copper bulls are refusing to give up. Weaker dollar might prompt another test of resistance level.

- Broad based bias is still downwards.

- Copper is currently trading at $2.78/pound, up 1.4% today, immediate support lies at $2.59 & resistance at $2.85, 2.93, and 3.07.

|

Gold |

+1.87% |

|

Silver |

+3.94% |

|

Copper |

+1.42% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand