Brazil's current account balance for the month of September was USD -3076 mn. For the period of October the current account balance is expected to be USD- 4110 mn on a consensus.

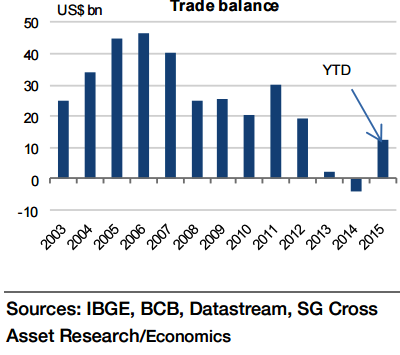

The domestic growth weakness is supporting the external environment. Adding to it, the currency weakness appears to prove profiting to the country's exports. Less than half of improvement in current account is on the rising trade surplus year to year, trade services and income transfers are also on the same pace.

"On our forecast of -USD4,148m for October, we estimate that the YTD current account balance improved from -USD82.9bn to -USD53.5bn (or a YTD improvement of nearly 35% )", says Societe Generale in a research note.

A serious deterioration in investment demand in the country is indicated by the sharp declines in imports. Continuous improvement in exports should associate the improvement in the current account balance and its sustainability.

"The current account could be heading for a substantial correction this year in dollar terms. However, given the possibility that BRL depreciation this year could be over 30%, we will likely see a moderate improvement in the current account balance to GDP ratio", added Societe Generale.

It should be observed if BRL depreciation alone can boost the growth and competitiveness of the country's exports to that level, which is needed to improve investment prospects. One obstacle is external demand.

Continued exports improvement needed to sustain Brazil's current account balance improvement

Thursday, November 26, 2015 9:27 AM UTC

Editor's Picks

- Market Data

Most Popular

7

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022