The Gigafactory by Tesla Motors located deep in the Nevada desert is not even finished yet, but countries are already clamoring for the next one to be built in their own countries. While nations seem to believe that Tesla is only going to go higher, a manager of a small hedge fund recently mocked Elon Musk during a private conference.

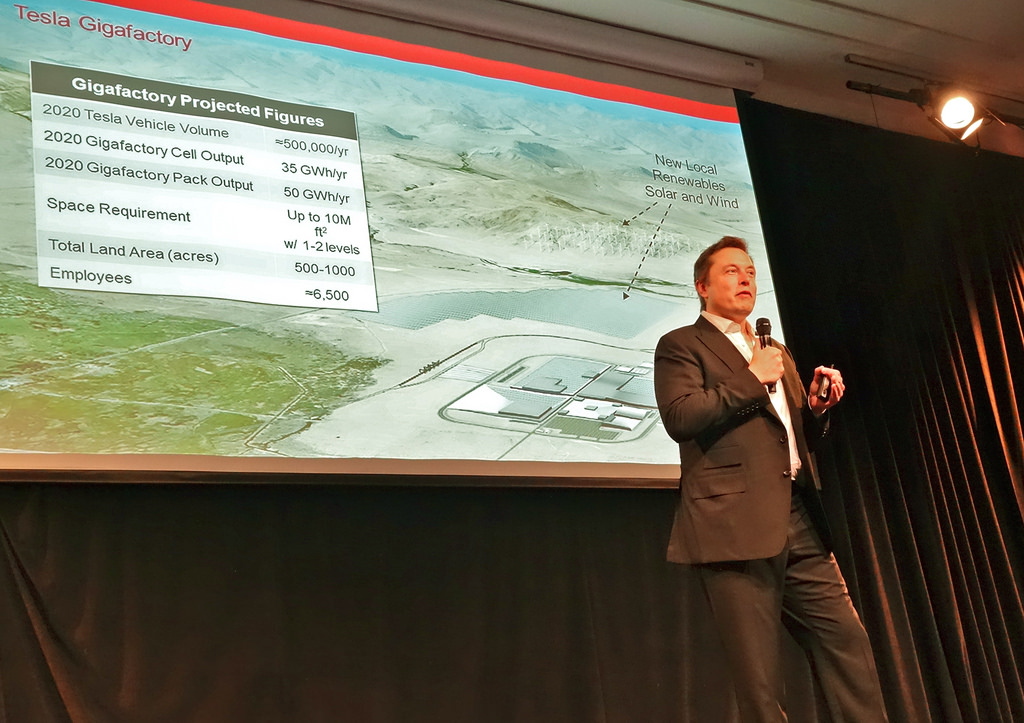

Right now, the Nevada Gigafactory is less than a quarter way to being finished, but the company is already making plans to find another spot to build a second one by 2017, Futurism reports. This has led to an explosion of enthusiasm from interested countries, largely European ones.

The search was announced at the same time as Tesla’s partnership with German engineering firm Grohmann Engineering was revealed. Tentatively known as Gigafactory 2, it will serve as both a production site for electric batteries used for cars and other products and an actual manufacturing plant for vehicles.

With the prospect of thousands of jobs and billions of dollars in investments, it’s no wonder that countries like Portugal and The Netherlands are campaigning to have the facility built on their soil. The complex in Nevada is set to hire over 6,500 workers, for example, almost all of whom will be locals.

On that note, it would seem that one hedge fund manager by the name of Mark Spiegel shares the disdain of many in Wall Street have for Tesla. Spiegel runs the firm Stanphyl Capital, which is a small company that only holds about $9 million in investments, Business Insider reports.

At a recent private confab of investors and stock market moguls, Spiegel presented slideshow after slideshow of reasons why Tesla is headed for a ditch. According to him, Musk is currently shining his investors and is only leading them to a financial trap with his failing company.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates