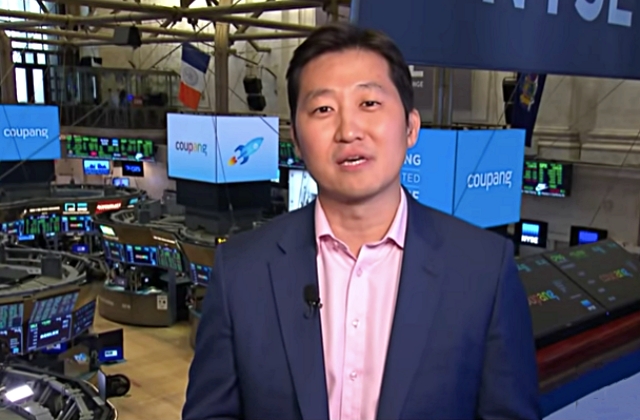

Coupang founder, Kim Bom Seok, was revealed to have stepped down from the company’s board. But then again, the move is for the betterment of the business as he is quitting just to have more time to work on overseas expansion.

Announcement of Kim Bom Seok’s leave

Kim Bom Seok’s decision to exit from Coupang’s board was announced on Thursday, June 17. He is now preparing to find more opportunities for the firm to also grow in regions outside of South Korea.

"Coupang Board Chair Kim Bom Seok stepped down from the board,” The Korea Times quoted a company official as saying. “The decision reflects his desire to dedicate more time to help the company find greater opportunities for overseas business."

As he is no longer part of the board, it was explained that the Coupang founder will no longer be involved in the company's business in Korea. Rather, he will now focus on the overseas side of the trade.

Then again, while he will be significantly absent in the management of the Korean side of the business, he will not lose his CEO and other board titles at Coupang. To replace him, Kang Han Seung has been promoted to the board. Cho Joon Hee, the product development division head at Coupang, and Yoo In Jong, safety management division manager, were also added as new board members.

What pushed the Coupang founder to give up his board post

It was suggested that Kim Bom Seok’s decision to focus overseas was due to the recent stock price result at the New York Stock Exchange. Coupang’s stock price dropped by about 35% from $69 and was trading at $40 per share after the initial surge shortly after the initial public offering last year. During that time, investors were said to have asked Coupang to widen its portfolio.

So now, the request may finally be granted as Kim Bom Seok will now work for the overseas business of Coupang. Analysts also believe that his exit from the Korean market will help the company because he can now explore other opportunities for Coupang to grow further by finding new ventures and strategic investments that will benefit the firm, Pulse News reported.

Wall Street Futures Tumble as U.S.-Iran Conflict Escalates and Oil Prices Surge

Wall Street Futures Tumble as U.S.-Iran Conflict Escalates and Oil Prices Surge  Gold Prices Steady in Asia, Set for Strong February Gains on Safe-Haven Demand

Gold Prices Steady in Asia, Set for Strong February Gains on Safe-Haven Demand  Panama Investigates CK Hutchison’s Port Unit After Court Voids Canal Contracts

Panama Investigates CK Hutchison’s Port Unit After Court Voids Canal Contracts  Strait of Hormuz LNG Crisis Triggers Global Energy Market Shock

Strait of Hormuz LNG Crisis Triggers Global Energy Market Shock  Greg Abel’s First Berkshire Hathaway Shareholder Letter Signals Continuity, Caution, and Capital Discipline

Greg Abel’s First Berkshire Hathaway Shareholder Letter Signals Continuity, Caution, and Capital Discipline  Global Markets Reel as Euro Falls, Swiss Franc Surges and Oil Prices Spike After U.S.-Israel Strike on Iran

Global Markets Reel as Euro Falls, Swiss Franc Surges and Oil Prices Spike After U.S.-Israel Strike on Iran  Australia Housing Market Hits Record High Despite RBA Rate Hike

Australia Housing Market Hits Record High Despite RBA Rate Hike  Argentina Tax Reform 2026: President Javier Milei Pushes Lower Taxes and Structural Changes

Argentina Tax Reform 2026: President Javier Milei Pushes Lower Taxes and Structural Changes  Anthropic Refuses Pentagon Request to Remove AI Safeguards Amid Defense Contract Dispute

Anthropic Refuses Pentagon Request to Remove AI Safeguards Amid Defense Contract Dispute  Trump Media Weighs Truth Social Spin-Off Amid $6B Fusion Energy Pivot

Trump Media Weighs Truth Social Spin-Off Amid $6B Fusion Energy Pivot  Middle East Airspace Shutdown Disrupts Global Flights After U.S.-Israel Strikes on Iran

Middle East Airspace Shutdown Disrupts Global Flights After U.S.-Israel Strikes on Iran  Global Markets React as Dollar Surges, Swiss Franc Rallies After U.S.-Israel Strike on Iran

Global Markets React as Dollar Surges, Swiss Franc Rallies After U.S.-Israel Strike on Iran  Dominican Republic Unveils Massive Rare Earth Deposits to Boost High-Tech and Energy Sectors

Dominican Republic Unveils Massive Rare Earth Deposits to Boost High-Tech and Energy Sectors  Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA

Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA  Samsung Electronics Stock Poised for $1 Trillion Valuation Amid AI and Memory Boom

Samsung Electronics Stock Poised for $1 Trillion Valuation Amid AI and Memory Boom  Meta Signs Multi-Billion Dollar AI Chip Deal With Google to Power Next-Gen AI Models

Meta Signs Multi-Billion Dollar AI Chip Deal With Google to Power Next-Gen AI Models  Lynas Rare Earths Shares Surge 7% After Malaysia Renews Processing Plant Licence for 10 Years

Lynas Rare Earths Shares Surge 7% After Malaysia Renews Processing Plant Licence for 10 Years