Quite a few analysts were bullish about the recent week’s BTC price bounce from $6,854, we’ve been one among them because of couple of technical bullish driving forces.

While articulating the bitcoin price (BTCUSD at Coinbase exchange) has risen more than 15.75% in this month so far.

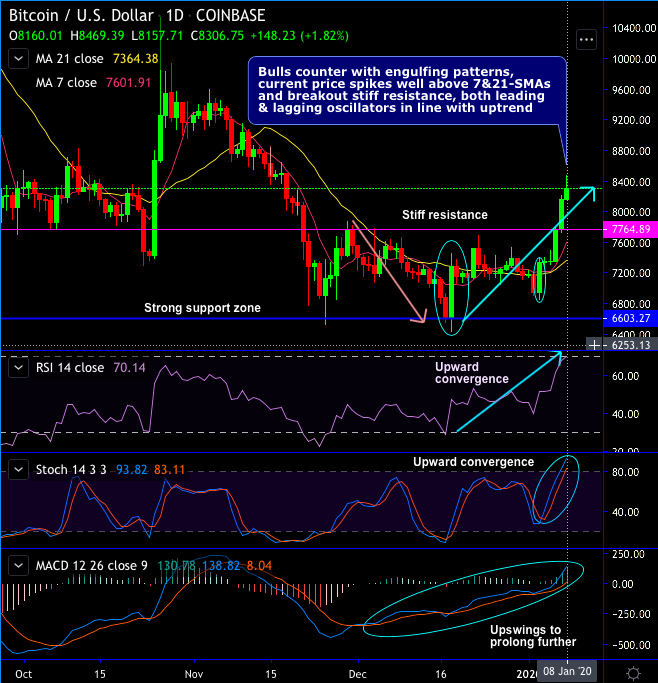

Technically, bulls counter with engulfing patterns at $7,285 and $7,334 levels, consequently, the minor trend spikes well above 7 & 21-DMAs.

As there was a higher low than the asset’s previous cycle low of US$6,500 which it hit in mid-December 2018, and the current price has broken out stiff resistance of $7,764 and hit $8,000 levels, now is on the verge of $8,500 level. We could now foresee further upside traction as both leading & lagging oscillators in line with uptrend (refer daily chart).

Both RSI & Stochastic curves show upward convergence to the ongoing upswings that indicates the intensified buying momentum. While bullish MACD & DMA crossover signal prevailing uptrend to prolong further.

Shooting star followed by hanging man patterns plummet prices below EMAs, Hammer & Dragonfly Doji counters at $7,513 and $7,355 levels respectively (refer weekly plotting).

Bulls will hope that all these patterns are indicative of a trend reversal. When an asset’s price consistently makes higher lows or higher highs towards the end of a cycle, this can be a sign of an impending price break-out.

Accordingly, we’ve recently setup a trading and hedging strategy so as to participate in the prevailing bullish run.

It seems to have been fetched the desirable yields by now as we had given targets of $8,500 level. Contemplating above technical factors, we wish to uphold the same strategy on hedging grounds (current spot reference: $8,310 with day highs at 8,469 levels).

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  FxWirePro: USD/ZAR edges higher but bearish outlook persists

FxWirePro: USD/ZAR edges higher but bearish outlook persists  FxWirePro: USD/ZAR recovers slightly but bears are not done yet

FxWirePro: USD/ZAR recovers slightly but bears are not done yet  USDCHF Explodes Higher: Breaks to 0.78135 High – Bulls Eye 0.8000 Breakout

USDCHF Explodes Higher: Breaks to 0.78135 High – Bulls Eye 0.8000 Breakout  FxWirePro: GBP/AUD falls below 1.8900 ,bears keep the advantage

FxWirePro: GBP/AUD falls below 1.8900 ,bears keep the advantage  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  FxWirePro- Major European Indices

FxWirePro- Major European Indices  BTC Bombs Higher Despite Iran Conflict: Hits $69K+ – Buy the Dip at $67K for $80K Glory?

BTC Bombs Higher Despite Iran Conflict: Hits $69K+ – Buy the Dip at $67K for $80K Glory?  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  FxWirePro: EUR/ NZD extends drop, faces 38.2% fib support

FxWirePro: EUR/ NZD extends drop, faces 38.2% fib support