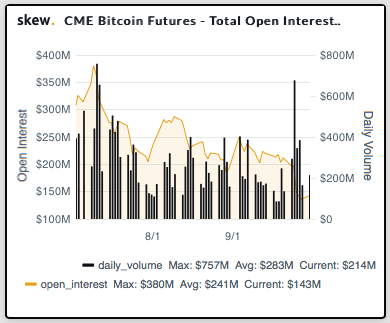

Contemplating with the price being decreased, along with that the declining OI (refer monthly open interest data which is in the negative numbers in the above nutshell provided by CME group and refer 1st exhibit for sloping OI curve), the underlying market is perceived to be making some sort of strength for the long-run.

This is because when both the participants (holder and writer) are liquidating their old positions, the Open Interest is most likely to slide.

While the JPM’s position proxies for the CME and BitMEX futures contacts are shown in the 2nd figure. Where the CME position proxy suggests the long base has declined markedly since their peak during the summer, and some further reduction this week.

By contrast, the BitMEX position proxy suggests a more marked capitulation of bitcoin longs over the past week. This position liquidation has also likely contributed to the sharp falls in bitcoin prices this week. But while the previous overhang of long bitcoin futures positions appears to have cleared in BitMEX futures, this is not yet true for CME contracts.

Finally, another recent development is that the CME has announced that it will launch options on its bitcoin futures in the first quarter of 2020. While the listing is subject to regulatory review, the contract would be a welcome development in that it expands the alternatives for investors to manage risk. Courtesy: JPM & skew.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge