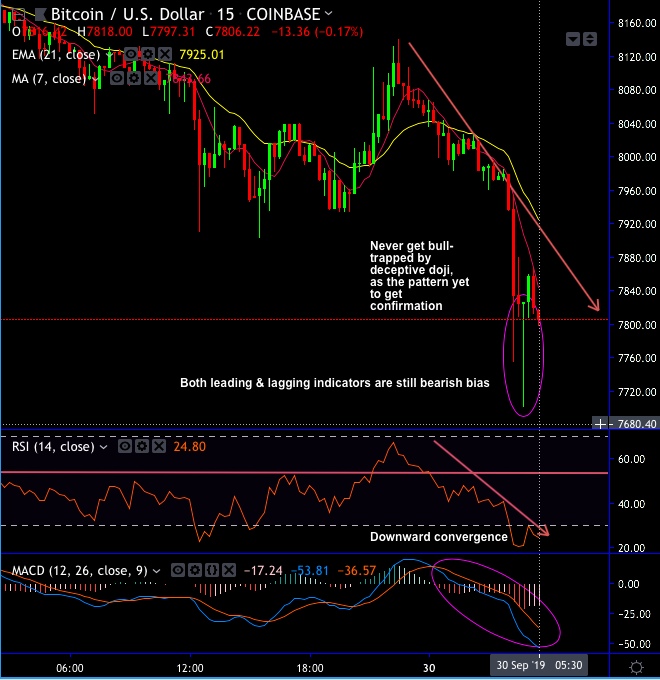

BTCUSD at Coinbase, forms dragonfly doji at $7,826 levels, but the bullish pattern is yet to get the better clarity from the technical indicators.

The doji that could be deceptive as both the leading and lagging indicators are still bearish bias (refer BTCUSD 15-min chart).

Whereas CME BTCV9 price shows failure swings at the stiff resistance and slides below SMAs again with bearish SMA and MACD crossovers (refer Bitcoin CME 1H chart), there’s no traces of any dramatic price jump on this plotting as well.

So, there is clear divergence observed between the underlying security (bitcoin at coinbase) and futures prices.

Strong support is seen at - 7450-7501 areas

Hence, we wish to initiate shorts in CME BTCV9 contracts as more price slumps are foreseen in the near-terms.

Target – $7,501 levels, stop loss - $8,034 levels, thereby, one can achieve attractive risk reward ratio with this trading strategy.

Please be noted that the writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Usually, as the contract period approaches expiry, the futures price likely to converge to the spot price of the underlying asset.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics