CME and Bakkt are the two predominant and globally renowned bitcoin futures market.

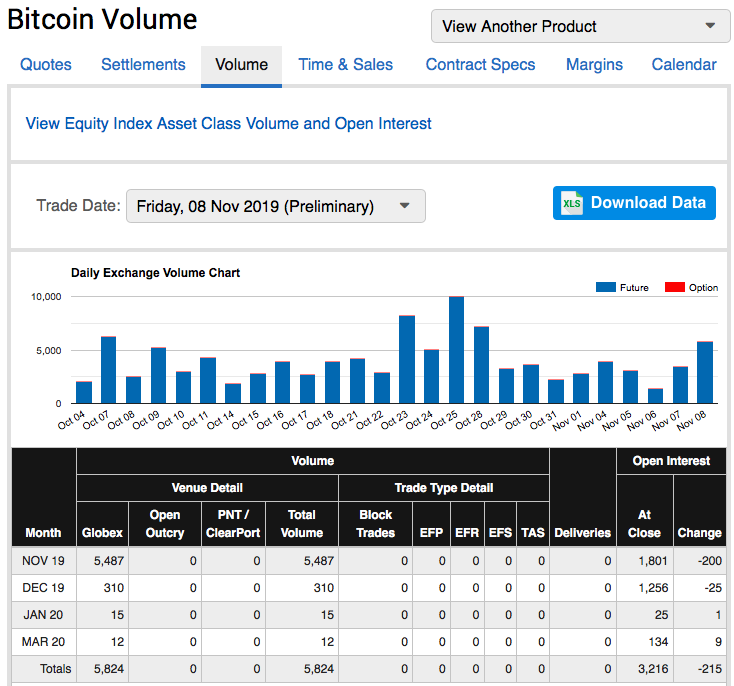

Of late, there has been a divergence in open interest between them, CME ominously missing appeal to the institutional investors as the number of long contracts experienced more than 300% plunge in open interest which is the least WoW drop four months. While Bakkt gains traction during the course of same period. Bakkt futures contracts have surged in the recent times, recording all-time highs during the week surpassing the $15 million USD mark. They took twitter handle to announce record daily volumes of 1,756 contracts.

Whereas the number of open interest long contracts on CME is now at October lows despite the 200%+ increase last month.

We recommend for trading purpose, avoid contracts with lower volumes and lower open interest. Generally, the volume and open interests would be small at the early stages of futures contract life and expands as it reaches the maturity period and again drop during close to expiration stage.

If both participants (buyer and seller) in a trade are initiating a new position, the open interest will increase. However, if one is initiating a new position and other liquidating his old position, there is no change in the open interest.

The price of CME BTC futures contracts of front end month has tumbled $9k by -0.23% in last week.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data