Dollar index trading at 99.12 (+1.17%)

Strength meter (today so far) - Aussie -1.44%, Kiwi -1.35%, Loonie -1.02%.

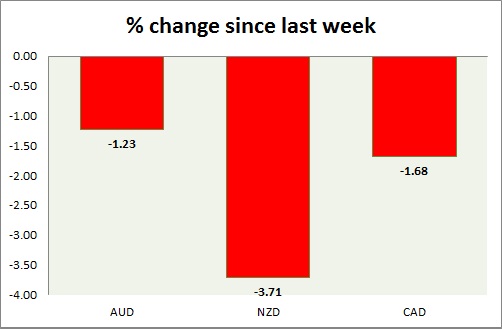

Strength meter (since last week) - Aussie -1.23%, Kiwi -3.71%, Loonie -1.68%.

AUD/USD -

Trading at 0.704

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Sell

Support -

- Long term - 0.60, Medium term - 0.69, Short term - 0.71

Resistance -

- Long term - 0.82, Medium term - 0.785 -0.79, Short term - 0.74

Economic release today -

- NIL

Commentary -

- Aussie on the last day of the week turned negative against Dollar. Non-farm payroll weighing in.

NZD/USD -

Trading at 0.652

Trend meter -

- Long term - Sell, Medium term - Range/sell, Short term - Range/Sell

Support -

- Long term - 0.56, Medium term - 0.625, Short term - 0.65

Resistance -

- Long term - 0.77, Medium term - 0.725, Short term - 0.7

Economic release today -

- NIL

Commentary -

- Kiwi is worst performer of the week down close to 4%, as dairy prices dropped further.

USD/CAD -

Trading at 1.33

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support -

- Long term - 1.19, Medium term - 1.28, Short term - 1.303,

Resistance -

- Long term - 1.38, Medium term - 1.35, Short term - 1.34

Economic release today -

- Unemployment rate dropped to 7% from 7.1%, despite rise in participation. Payroll gains were 44,400.

Commentary -

- Lower is the best performer today relatively but still down more than 1% against Dollar. However strength is impressive given the weakness in oil price. Better than expected unemployment probably supporting loonie.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand