Dollar index trading at 98.6 (+0.55%).

Strength meter (today so far) - Aussie -0.72%, Kiwi -0.37%, Loonie -0.38%.

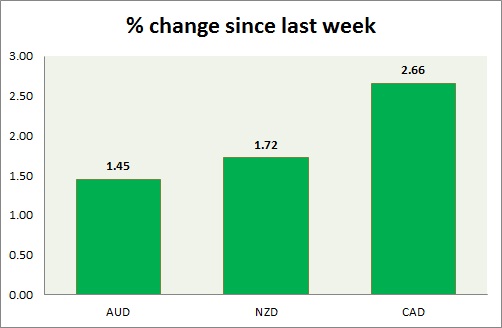

Strength meter (since last week) - Aussie -1.85%, Kiwi -1.19%, Loonie -0.86%.

AUD/USD -

Trading at 0.76

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Sell Resistance

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.79-0.80, Immediate - 0.775-0.778

Economic release today -

- New home sales grew 1.1% mom in February, compared to 1.8% prior.

- Private sector credit rose 6.2% YoY and 0.5% mom.

- AIG performance of manufacturing index scheduled for release at 23:30 GMT.

Commentary -

- Aussie selloffs gathered pace, however some bounce back might occur from short term support area. Rallies to be sold.

- Inverted hammer appeared in weekly chart. Bias remains downwards.

NZD/USD -

Trading at 0.747

Trend meter -

- Long term - Sell, Medium term - Buy/Range, Short term - Sell/Range

Support -

- Long term - 0.653, Medium term - 0.719-0.712, Short term - 0.738-0.736, Immediate - 0.744-0.741

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.768-0.772, Immediate - 0.757-0.76

Economic release today -

- ANZ business confidence rose to 35.8 from prior 34.4

- M3 money supply grew at 6.6% YoY in February.

Commentary -

- Pair is going down as dollar remains well bid across board.

- Very bearish with long upper shadow appeared in week chart. Very close to a grave stone doji. Bias downwards.

- However some profit booking might occur at immediate support area of a rising trend line.

USD/CAD -

Trading at 1.272

Trend meter -

- Long term - Buy, Medium term - Buy/Range, Short term - Range

Support -

- Long term - 1.17, Medium term - 1.24-1.234, Short term - 1.247-1.245

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.284

Economic release today -

- GDP fell by -0.1% in January mom.

Commentary -

- Canadian dollar successfully bounced back from lower bound of the range as crude oil failed to gain traction. Loonie might now be aiming for the higher bound of the current range.

- Scope of a full scale breakout above looks limited without a catalyst as NFP looms ahead in the week.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand