Dollar index trading at 96. 46 (-0.28%).

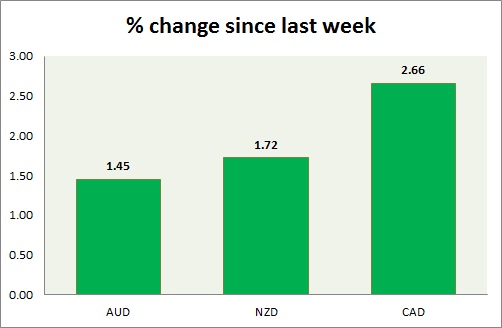

Strength meter (today so far) - Aussie +0.73%, Kiwi +0.61%, Loonie +16%.

Strength meter (since last week) - Aussie +0.73%, Kiwi +0.61%, Loonie +0.16%.

AUD/USD -

Trading at 0.765

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Sell Resistance

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.79-0.80, Immediate - 0.766-0.769

Economic release today -

- NIL

Commentary -

- Aussie posed lackluster bounce back so far over weaker NFP report. RBA rate decision tomorrow might provide further guidance. Rallies will remain capped.

- Weaker exports prices are weighing on the currency.

NZD/USD -

Trading at 0.761

Trend meter -

- Long term - Sell, Medium term - Buy/Range, Short term - Range

Support -

- Long term - 0.653, Medium term - 0.719-0.712, Short term - 0.738-0.736, Immediate - 0.744-0.741

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.768-0.772, Immediate - 0.76-0.763

Economic release today -

- NIL

Commentary -

- Pair's comeback gathered pace from trend line support over weaker than expected NFP report on Friday.

- Very bearish doji with long upper shadow remain in focus in weekly chart. Very close to a grave stone doji. Bias is still downwards. However weaker dollar might provide support.

USD/CAD -

Trading at 1.245

Trend meter -

- Long term - Buy, Medium term - Buy/Range, Short term - Range

Support -

- Long term - 1.17, Medium term - 1.24-1.234, Short term - 1.247-1.245

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.28 -1.284

Economic release today -

- Ivey PMI surprised on the upside. Registered 56 compared to prior 50.8. However PMI shrank to 47.9 from 49.7 when seasonally adjusted.

Commentary -

- Canadian dollar has come back to lower bound of the range. Weaker NFP and stronger crude price is providing support. Volume and volatility will be back tomorrow after Easter holiday across globe.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand