Dollar index trading at 97.89 (-0.52%).

Strength meter (today so far) - Aussie +1.42%, Kiwi +0.75%, Loonie +0.53%.

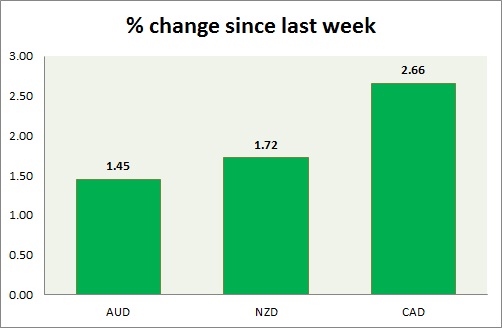

Strength meter (since last week) - Aussie +1.45%, Kiwi +1.72%, Loonie +2.66%.

AUD/USD -

Trading at 0.778

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Sell Resistance

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.79-0.80, Immediate - 0.771-0.773 (Broken)

Economic release today -

- Australian unemployment dropped to 6.1% in March with net 37.7K people added to payroll.

- New motor vehicle sales improved by 4.4% in March.

- Inflation expectation rose to 3.4% from 3.2% prior.

Commentary -

- Aussie is best performer today, riding on jobs report and weaker dollar. However it is still too early to call a reversal as short term resistance holds. Might test that level in coming days.

NZD/USD -

Trading at 0.764

Trend meter -

- Long term - Sell, Medium term - Buy/Range, Short term - Range/Sell resistance

Support -

- Long term - 0.653, Medium term - 0.719-0.712, Short term - 0.738-0.736, Immediate - 0.744-0.741

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.768-0.772, Immediate - 0.75-0.753 (Broken)

Economic release today -

- NIL

Commentary -

- Kiwi's bounce back is pretty impressive, given trend bias remains downwards, however a break of short term resistance remains unlikely, without any event catalyst.

- Bearish Doji in weekly candle remains in play.

USD/CAD -

Trading at 1.224

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 1.17, Medium term - 1.24-1.234(Broken), Short term - 1.205-1.20

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.267-1.27. Immediate - 1.235-1.241

Economic release today -

- NIL

Commentary -

- Loonie is BOC rate decision and higher oil price. Yesterday's break of important support is keeping the pair downwards. Move towards 1.20-1.19 very much likely.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand