Dollar index trading at 94.53 (+0.4%).

Strength meter (today so far) - Aussie +0.03%, Kiwi -0.21%, Loonie -0.46%.

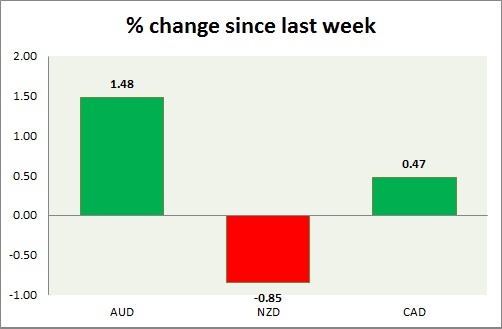

Strength meter (since last week) - Aussie +1.48%, Kiwi -0.85%, Loonie +0.47%.

AUD/USD -

Trading at 0.795

Trend meter -

- Long term - Sell, Medium term - Sell, Short term - Range/Buy Support

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.756-0.75

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.79-0.80

Economic release today -

- Unemployment rate remained at 6.2% unchanged from prior, however payroll dropped by 2900

Commentary -

- Aussie bulls remain in control waiting for catalyst to break key resistance. Break would push prices higher towards 0.83.

NZD/USD -

Trading at 0.746

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell resistance

Support -

- Long term - 0.653, Medium term - 0.719-0.712, Short term - 0.738-0.736, Immediate - 0.744-0.741

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.768-0.772

Economic release today -

- NIL

Commentary -

- Kiwi is the worst performing currency as RBNZ dovish bias remain in focus. Price is now hovering close to immediate support area, break is very much likely.

USD/CAD -

Trading at 1.209

Trend meter -

- Long term - Buy, Medium term - Range/Sell, Short term - Range/Sell

Support -

- Long term - 1.17, Medium term - 1.1840-1.18, Short term - 1.20-1.196

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.235-1.241, Immediate - 1.225-1.228

Economic release today -

- Building permits grew by 11.6% m/m in March.

Commentary -

- Loonie lost ground as oil prices retreat from this year's high. Further rise can't be ruled out as the pair jumped back from key support areas.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?