Dollar index trading at 97.62 (+0.52%)

Strength meter (today so far) - Aussie +0.21%, Kiwi -0.75%, Loonie -0.11%.

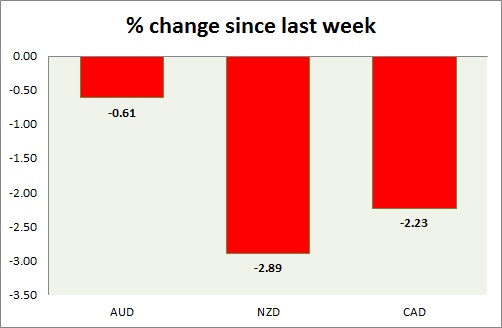

Strength meter (since last week) - Aussie -0.61%, Kiwi -2.89%, Loonie -2.23%.

AUD/USD -

Trading at 0.738

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.71-0.715

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.793-0.796

Economic release today -

- Inflation expectations rose to 3.4% in July.

Commentary -

- Aussie is the better performer this week, as improved economic dockets providing some relief. Sell Aussie with stop around 0.785 and 0.825 to target 0.715, 0.70 and 0.65.

NZD/USD -

Trading at 0.652

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/sell resistance

Support -

- Long term - 0.653, Medium term - 0.65, Short term - 0.65

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.737-0.74, Immediate - 0.705

Economic release today -

- Dairy prices dropped by -10.7% in latest auction.

Commentary -

- Kiwi is at crucial support of 0.65. Outlook still remain bearish. Focus is on RBNZ next week.

USD/CAD -

Trading at 1.294

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.17, Medium term - 1.1840-1.18, Short term - 1.217-1.213

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.30

Economic release today -

- NIL

Commentary -

- Canadian dollar remains sell against dollar, the pair might reach as high as 1.38. BOC's rate cut keeping dollar bulls energized. Weaker oil price might push loonie even lower.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate