Dollar index trading at 96.73 (+0.16%)

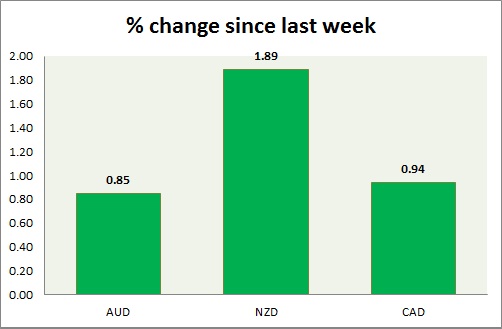

Strength meter (today so far) - Aussie +0.87%, Kiwi +1.05%, Loonie +0.89%.

Strength meter (since last week) - Aussie +0.26%, Kiwi +0.79%, Loonie +0.09%.

AUD/USD -

Trading at 0.734

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.60, Medium term - 0.71, Short term - 0.71-0.715

Resistance -

- Long term - 0.87, Medium term - 0.83, Short term - 0.78, Immediate - 0.75

Economic release today -

- NIL.

Commentary -

- Aussie is up today as overall commodity pack advanced against dollar. Sell Aussie with stop around 0.785 and 0.825 to target 0.715, 0.70 and 0.65.

NZD/USD -

Trading at 0.67

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/Buy support

Support -

- Long term - 0.653, Medium term - 0.65, Short term - 0.65

Resistance -

- Long term - 0.883, Medium term - 0.80-0.805, Short term - 0.737-0.74, Immediate - 0.705

Economic release today -

- NIL

Commentary -

- Though trend remains bearish, long Kiwi, with 0.65 as support in the shorter term.

USD/CAD -

Trading at 1.292

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 1.17, Medium term - 1.217, Short term - 1.265

Resistance -

- Long term - 1.298-1.315, Medium term - 1.30-1.35, Short term - 1.30

Economic release today -

- NIL

Commentary -

- Canadian dollar remains sell against dollar, the pair might reach as high as 1.38. However loonie gained lot of grounds today against dollar as oil price bounced back sharply.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate