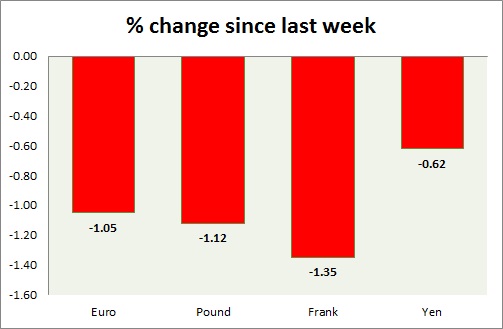

Dollar scaled back loss made after Janet Yellen's comments in today's trading & gaining ground fast after better data released from US. The performance remained mixed against the majors (EUR, GBP, JPY, & CHF) so far this week. A chart and table is attached for explanation.

- Euro failed to advance over the Greek deal and comments from Yellen. Extended loss after the data in US showed strong momentum. Durable goods order grew at 2.8% compared to 1.6%. Real weekly earnings also up by 1.2%. CPI and jobless claims were more on neutral side. The data from Europe were mixed. German employment continued growth with another 20,000 job gain. Greek situation still not over. Votes over it will remain the focus for Euro. Currently trading at 1.125.The pair has broken below support of 1.127 and may break below to test the January low of 1.11.

- Pound still the best performing currency, losing ground since better data came out of US. GDP data published today showed growth as expected at 2.7% YoY. Currently trading at 1.546. Immediate Support lies at 1.535 & Resistance 1.56.

- Yen continue the range unimpressed by data, news and events. CPI, Retail sales & industrial production data to be released from 23:30 GMT could provide queue. Currently trading at 119.1. Immediate Support lies at 118.2 & Resistance 120.5.

- Franc, losing ground after better data from US. The unimpressed attitude towards better than expected industrial data growing at 2.5% QoQ, shows that the pair is not focusing on economic dockets. Currently trading at 0.953. Immediate Support lies at 0.937 & Resistance 0.954. The pair may break above and move towards its target of 0.976.

|

Euro |

-1.01% |

|

Pound |

0.4% |

|

Frank |

-1.66% |

|

Yen |

0.08% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate