Dollar index trading at 97.04 (-0.14%).

Strength meter (today so far) - Euro +0.23%, Franc -0.10%, Yen -0.19%, GBP -0.09%

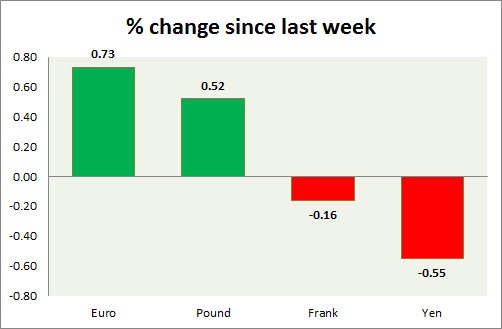

Strength meter (since last week) - Euro +0.73%, Franc -0.16%, Yen -0.55%, GBP +0.52%

EUR/USD -

Trading at 1.104

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range/ Buy

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085

Resistance -

- Long term - 1.175-1.18, Medium term - 1.155-1.16, Short term - 1.14-1.145, Immediate - 1.125-1.132

Economic release today -

- Euro zone Zew economic sentiment rose to 47.6 for August from 42.7 in July.

Commentary -

- Euro is the best performer this week, however it is facing heavy selling pressure as it tried to test 1.11 area today.

GBP/USD -

Trading at 1.557

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512, Immediate - 1.544-1.54

Resistance -

- Long term - 1.592-1.616, Medium term - 1.595, Short term - 1.572

Economic release today -

- CB leading economic index dropped by -0.2% in July from -0.4% in June.

Commentary -

- Pound is continuing its range. Bulls were halted around 1.562, whereas support lies around 1.54 area.

USD/JPY -

Trading at 124.9

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/Buy

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 119.7, Immediate - 120.7

Resistance -

- Long term - 130, Medium term - 127.5, Short term - 127.5.

Economic release today -

- Preliminary reading showed machine tools orders rose by 1.6% in July.

- Corporate goods price index to be released at 23:50 GMT.

- BOJ will release minutes at 23:50 GMT.

Commentary -

- Yen is the worst performer today and this week as Chinese devaluation of Yuan raising fear of currency war in Asia. Yen might lose to 127 against dollar if support around 121 holds.

USD/CHF -

Trading at 0.985

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.95

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- NIL.

Commentary -

- Franc is looking like, posing an interim top against Dollar, however SNB is keeping Franc pushed down.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?