Dollar index trading at 95.97 (-0.50%).

Strength meter (today so far) - Euro +0.70%, Franc +0.39%, Yen +0.43%, GBP -0.01%

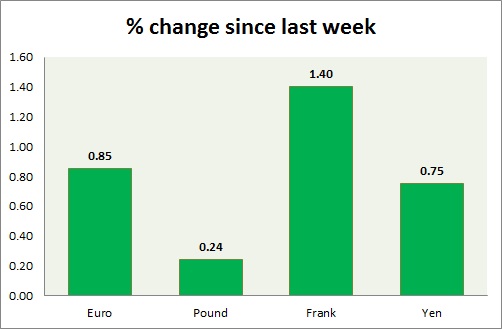

Strength meter (since last week) - Euro -0.29%, Franc -0.11%, Yen -0.05%, GBP -0.35%

EUR/USD -

Trading at 1.12

Trend meter -

- Long term - Sell, Medium term - Range, Short term - Range

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085

Resistance -

- Long term - 1.175-1.18, Medium term - 1.155-1.16, Short term - 1.14-1.145, Immediate - 1.125-1.132

Economic release today -

- NIL

Commentary -

- Euro jumped back as FED minutes were interpreted more dovish than market was anticipating.

GBP/USD -

Trading at 1.568

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512, Immediate - 1.544-1.54

Resistance -

- Long term - 1.592-1.616, Medium term - 1.595, Short term - 1.572

Economic release today -

- Conference board survey showed significant improvement in manufacturing sector.

- Retail sales grew by 0.1% in July much weaker than 0.4% anticipated, however sales excluding fuel rose by 0.4%.

Commentary -

- Pound is continuing its range as downbeat data poured water on the hope breakout. Active call - Buy Pound against Dollar, targeting 1.595 area and 1.609 area with stop loss around 1.54 and 1.53 area.

USD/JPY -

Trading at 123.4

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/Buy

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 119.7, Immediate - 120.7

Resistance -

- Long term - 130, Medium term - 127.5, Short term - 127.5.

Economic release today -

- NIL

Commentary -

- Yen is up today, driven by risk aversion sentiment. However, broadly it remains sell against Dollar. Yen might lose to 127 against dollar if support around 121 holds.

USD/CHF -

Trading at 0.962

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.95

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- Trade balance rose further to 3.741 billion in July, from 3.51 billion in June.

Commentary -

- Franc is the best performer this week, driven by weak dollar and haven buying. Active call - Sell Dollar against Franc targeting 0.93 area, with stop around 0.98 area.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand