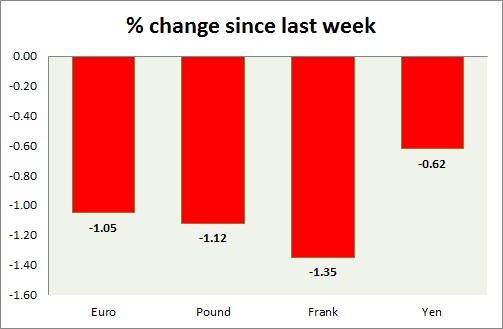

Dollar further advanced against the majors (EUR, GBP, CHF, and JPY) taking support from the rising yields. A chart and table is attached for explanation.

- Euro broken below the support of 1.11 and further fell against the dollar. Greece unemployment worsened at 26% and German retail sales fell by 3.9% adding further pressure on Euro. The pair traded as low as 1.102 in intraday trading. Euro is currently trading at 1.107 rising slightly after the policy announcement. Focus is on ECB press conference. Immediate Support lies at 1.10 & Resistance 1.12.

- Pound has erased gains against dollar further as dollar strengthened across board. BOE kept its rates unchanged. Pound is currently trading at 1.525. Immediate Support lies at 1.52 & Resistance 1.535.

- Yen is among the top losers today, as the risk trend failed to gain traction after the sharp selloff in the equities. Could gain direction from the ECB or NFP report. Yen is currently trading at 120.33, yet to break the resistance. Immediate Support lies at 118.2 & Resistance 120.5.

- Franc, still the top loser of the week, failed to gain from safe haven bids but the bullish momentum is somewhat reduced to slower pace. Could gain further momentum from ECB press conference. Currently trading at 0.966, down 0.30% for the day and still moving towards its target sub 0.98. Immediate Support lies at 0.939 & Resistance 0.975.

|

Euro |

-1.05% |

|

Pound |

-1.12% |

|

Frank |

-1.35% |

|

Yen |

-0.62% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings