Dollar index trading at 95.16 (-0.38%).

Strength meter (today so far) - Euro +0.53%, Franc -0.22%, Yen -0.11%, GBP -0.09%

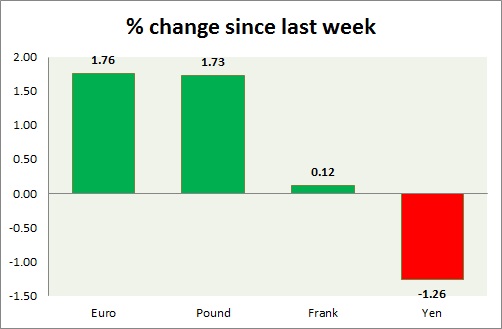

Strength meter (since last week) - Euro +1.76%, Franc -0.12%, Yen -1.26%, GBP +1.73%

EUR/USD -

Trading at 1.127

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range

Support

- Long term - 1.048-1.036, Medium term - 1.065-1.06, Short term - 1.08-1.085

Resistance -

- Long term - 1.175-1.18, Medium term - 1.14, Short term - 1.132 (broken), Immediate - 1.122 (broken)

Economic release today -

- NIL

Commentary -

- Euro gained further ground ahead of FOMC next week as FED is expected to keep policy steady.

GBP/USD -

Trading at 1.544

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Sell

Support -

- Long term - 1.425-1.417, Medium term - 1.497-1.49, Short term - 1.518-1.512,

Resistance -

- Long term - 1.592-1.616, Medium term - 1.585, Short term - 1.543-1.545

Economic release today -

- Consumer inflation expectations dropped to 2% in August from 2.2% prior.

Commentary -

- Pound is hovering just below key resistance area around 1.55 area.. Active call - Sell Pound targeting 1.44 area with stop loss around 1.58 area.

USD/JPY -

Trading at 120.6

Trend meter -

- Long term - Buy, Medium term - Range/Buy, Short term - Range/

Support -

- Long term - 113.7-112.9, Medium term - 115.7-115, Short term - 118

Resistance -

- Long term - 130, Medium term - 127.5, Short term - 124.5

Economic release today -

- NIL

Commentary -

- Yen is the worst performer this week, failing to gain over equity sell offs. Active call - Sell USD/JPY targeting 114.7 area with stop loss around 122

USD/CHF -

Trading at 0.972

Trend meter -

- Long term - Buy, Medium term - Range, Short term - Range/Buy

Support -

- Long term - 0.88, Medium term - 0.90, Short term - 0.93

Resistance -

- Long term - 1.174, Medium term - 1.025-1.02, Short term - 0.984-0.987

Economic release today -

- NIL

Commentary -

- Franc is likely to weaken further as SNB keeps selling Franc especially against Euro.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand