Demand augmenting measures are needed to revive India’s waning consumption growth; this will support convergence of inflation rates across regions and states, making monetary policy more effective, and between CPI and WPI as firms regain pricing power, according to the latest report from ANZ Research.

India’s inflation data mirror the weak consumption trends in recent months. Although headline inflation for September edged higher towards the Reserve Bank of India’s (RBI) target, it was led primarily by food prices and is likely to be short-lived, the report added.

Meanwhile, core inflation has continued to slip, in line with weak demand. However, the difference between rural and urban consumer price index (CPI) has been amplified in 2019. Higher food prices have pushed up urban CPI relative to its rural counterpart despite food occupying a higher weight in the rural CPI basket.

Core inflation has been moderating for both. The difference in inflation rates is visible across Indian states as well, with the degree of inter-state variation also increasing in recent years. More states have exhibited slower headline and food price inflation in the last two years, compared with their six-year averages.

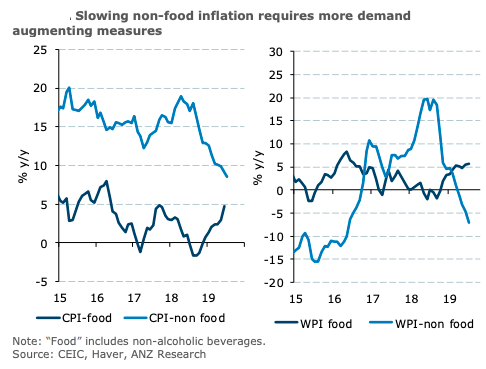

The trends in CPI and wholesale price index (WPI) are also diverging, led by the difference in non-food products. It is clear that manufactured products are driving the slide in WPI, indicative of the weak pricing power of industrial companies.

This sits with the sharp decline in the RBI’s forward-looking surveys for capacity utilisation rates. Amid the differing trends, what stands out is a secular slowdown in non-food inflation across these indices, ANZ Research further noted in the report.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm