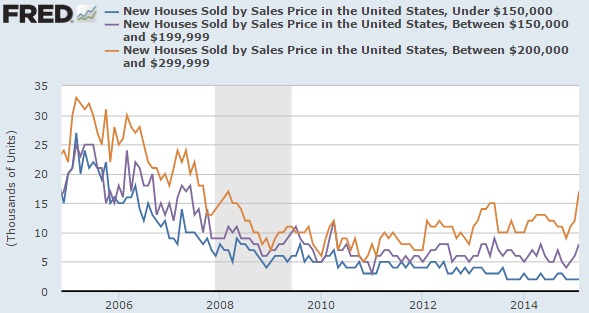

US housing markets recovering but still weak compared to pre-crisis level. During the housing crisis of 2008, builders were building more houses than actual demand, which led to lot of inventory still remaining to be sold off. Chart courtesy FRED, Sober look.

- Until the inventory clears up, average prices of house will not be rising much. Recent trend also points that price gap between the existing and new homes are widening further.

- In February existing home sales grew only by 1.2% whereas new homes saw rise of 7.8%. This disparity gave rise to another trend. Builders are investing less to refurbish the old homes.

Another trend is explained in the chart, among the new homes sold.

- New houses whose price are below $150,000 was in less demand compared to the ones with above $ 200,000 price. This trend was visible prior to 2008 crisis, however diminished by 2011.

- Recent rapid rise in sales of higher end homes, provide further evidence that US economy remains on solid ground

Dollar might suffer in the shorter term over dovish comments from FED officials, however there is hardly any alternative when growth is so commendable in US and fragile elsewhere.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand