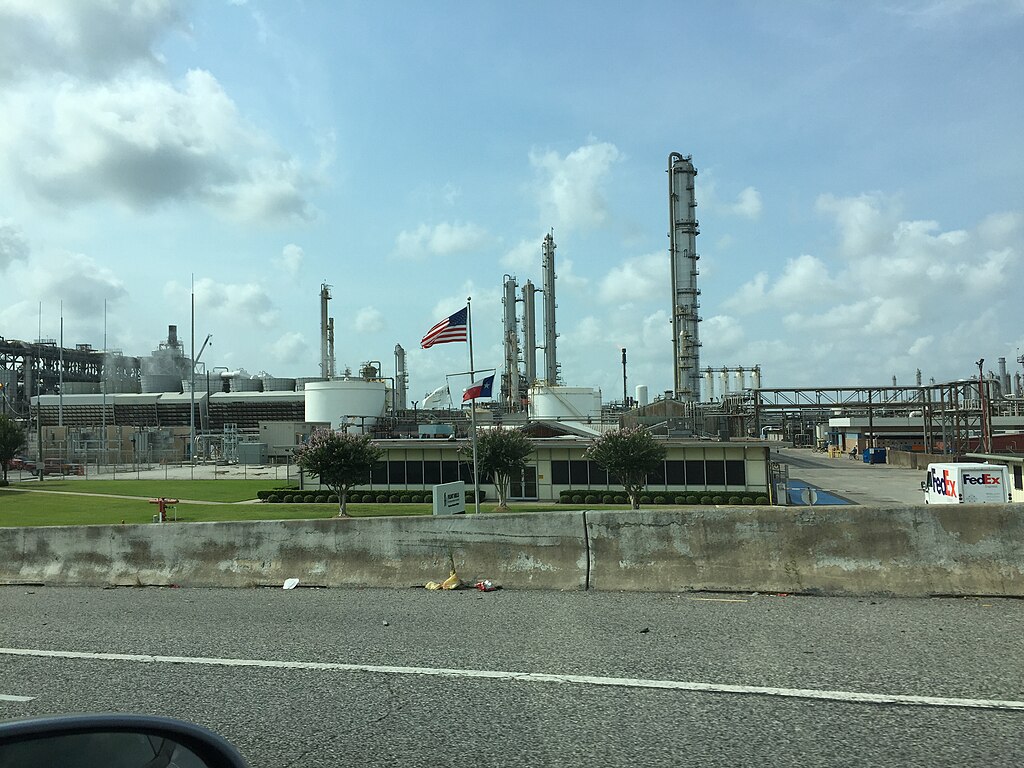

Diversified Energy Company PLC (NYSE:DEC) is reportedly in advanced talks to acquire Maverick Natural Resources, a private equity-backed firm operating in the Permian Basin, in a deal valued at approximately $1.3 billion. If finalized, this acquisition would mark Diversified Energy’s largest purchase to date, according to the Wall Street Journal.

The potential deal underscores confidence in expanding U.S. energy production and aligns with recent policy shifts under former President Donald Trump. Last week, Trump declared a national energy emergency, emphasizing the need for increased domestic oil and gas production while rolling back climate-related restrictions imposed during the Biden administration.

Maverick’s operations in the Permian Basin—a key oil-rich region in the southwestern United States—position Diversified Energy to capitalize on the basin’s status as the nation’s top oil-producing field. The Permian Basin is projected to produce 6.3 million barrels of oil per day in 2024, accounting for nearly half of total U.S. production.

This strategic acquisition highlights growing optimism in the energy sector amid expectations of fewer regulatory hurdles and rising demand for domestic energy resources. Diversified Energy’s expansion into the Permian Basin is seen as a pivotal move to strengthen its portfolio and solidify its presence in one of the world’s most prolific oil fields.

The deal, once completed, is expected to bolster Diversified Energy’s growth trajectory and reaffirm its commitment to leveraging high-yield assets in energy-rich regions. As the industry adapts to evolving market conditions, this acquisition positions Diversified Energy for long-term success.

By targeting strategic acquisitions and leveraging favorable market conditions, Diversified Energy continues to solidify its leadership in the energy sector.

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks