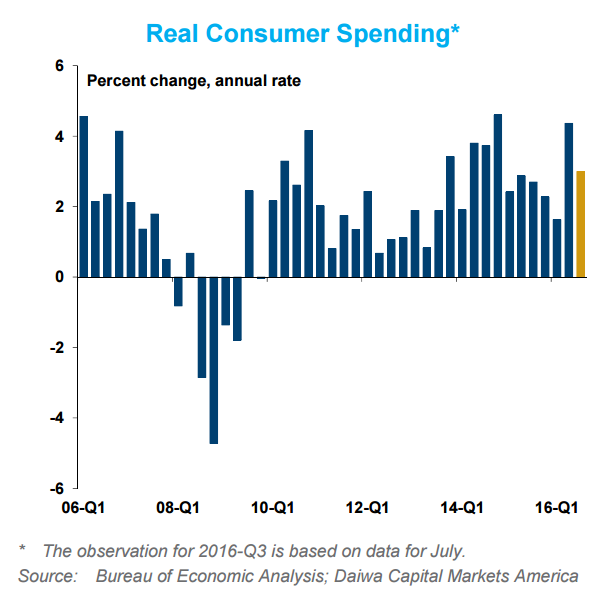

Consumer spending in the U.S. accounts for 70 percent of economic activity and is the main contributor to power overall growth in the second half of the year. Data released by the U.S. Commerce Department on Monday showed that consumer spending rose for the fourth straight month in July, a sign that domestic consumption could continue to drive U.S. economic growth over the second half of the year.

Americans continued spending, supported by job growth and low fuel costs. Consumer spending rose 0.3 percent in July in line with forecasts and followed a 0.5 percent increase the prior month. Incomes rose 0.4 percent, the most in three months, also matching estimates. Consumers upped their savings slightly in July, as the personal saving rate rose to 5.7 percent from an upwardly revised 5.5 percent in June.

“Personal spending will remain a key source of support for economic activity this quarter,” said Millan Mulraine, deputy chief U.S. macro strategist at TD Securities USA (LLC).

The good pace of consumer spending should reinforce the view of most Fed officials that the economy is performing well. Hawkish comments from Federal Reserve Chair Yellen on Friday have strengthened the case for sooner rate hikes from the Fed. The probability of a hike in September rose from 24 percent (Monday last week), as high as 42 percent (last Friday), Lloyds bank said.

If another report on Friday shows robust job gains in August, it would further boost expectations for Federal Reserve policymakers to raise interest rates next month. Consumer confidence, a possible indicator of future spending, has been hovering at a healthy but tempered level. U.S. Conference Board later today is expected to record a modest decline in its consumer confidence index.

Manufacturing has been weighed down by global weakness, a strong dollar and the oil industry slump, but, has shown expansion for five straight months, albeit at a low level. Economists expect the Institute for Supply Management (ISM) to report Thursday that its index dipped in August but remained in expansion territory in another sign the industry is at least stabilizing. Construction spending may be due for a rebound in July and economists expect a modest 0.5 percent increase in July construction outlays.

Laura Rosner, an economist at BNP Paribas, described both the income and spending numbers for July as "solid." They will likely be read by Fed officials as confirmation of their economic outlook, which would help bolster the case for a September rate hike, she said.

The dollar index (DXY) was up 0.21 percent on the day at 95.77 at around 11:30 GMT. USD/JPY was trading at 102.27, while EUR/USD was at 1.1164.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate