The fact that the Fed is looking to hike rates in the same month that the ECB is preparing to increase its stimulus could suggest opening of the floodgates for another drop in the value of EUR/USD. ECB President Mario Draghi in his speech on Friday announced the extension of the monetary policy's degree of expansion clearly. Astonishingly the EUR/USD exchange rate reacted only relatively moderately, suggesting that a certain degree of ECB extension was already priced into the EUR exchange rates.

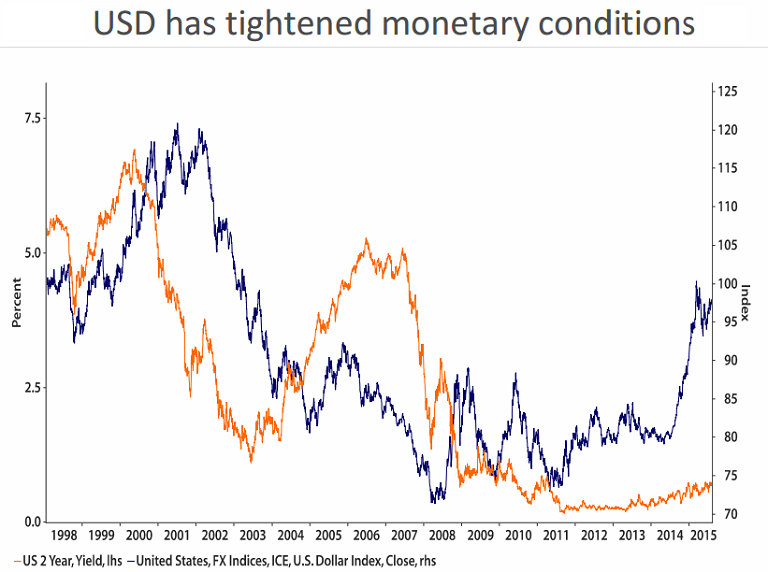

Also, over the past few sessions the Bloomberg spot USD index has dropped around 0.6% from its highs. This is despite the very clear message spelt out in this week's release of the FOMC's October minutes and in remarks by Fed ViceChair Fischer that the Fed is likely to tighten policy in December. This shows clearly that investors have begun to look beyond the December FOMC to the trajectory of Fed interest rates through 2016 and the message that the Fed is set to hike 'gradually' appears to be taking root.

In the 12 months to March 2015, EUR/USD fell by almost 14% and it is to be noticed that the build-up in long USD positions was one of the major facilitator in the downtrend. The fall could also be attributed to a dramatic softening in Eurozone monetary conditions during this period. However, in the current market scenario, with so much liquidity already in the system, there is a risk of a diminishing impact from additional ECB easing on market rates. Additionally, the market's enthusiasm for building up heavy long USD positions could be kept in check by the Fed and this could subdue downside potential for EUR/USD.

It is to be noted that unless US inflation indicators start producing upside surprises, the Fed may retain a cautious position with respect to policy tightening. This implies that the ECB may have to surprise markets in order to create some downside traction in EUR/USD over the next few months. Not only will a paring back of hawkish rhetoric from the Fed make the ECB's job tougher, but other central banks could take evasive easing action to prevent the ECB exporting its deflationary risks to them and this could prevent a significant broad based decline in the value of the EUR.

"We are of the view that EUR/USD will retain a downside bias. For now we are keeping parity in EUR/USD off and look for a move to 1.05 on a 3 month view. We will re-evaluate this position once the outcome of next month's ECB and Fed policy meetings is known", says Rabobank in a research note to its clients.

EUR/USD was trading at 1.0623 at 1053 GMT on Monday. Better-than-expected German and EZ PMIs released earlier today were largely ignored by the EUR bulls, who wait on the sidelines on fears of more ECB easing.

Downside traction in EUR/USD?

Monday, November 23, 2015 11:06 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  Japan Coalition Urges BOJ Independence as Sales Tax Cut Plan Advances

Japan Coalition Urges BOJ Independence as Sales Tax Cut Plan Advances  FxWirePro: USD/CAD steadies around 1.3680,retains bid tone

FxWirePro: USD/CAD steadies around 1.3680,retains bid tone  BOJ Signals Possible April Rate Hike as Ueda Eyes Inflation and Wage Growth Data

BOJ Signals Possible April Rate Hike as Ueda Eyes Inflation and Wage Growth Data  ECB Expands Euro Liquidity Backstop to Strengthen Global Role of the Euro

ECB Expands Euro Liquidity Backstop to Strengthen Global Role of the Euro  China Holds Loan Prime Rates Steady as PBOC Maintains Cautious Monetary Policy

China Holds Loan Prime Rates Steady as PBOC Maintains Cautious Monetary Policy  NZDJPY Retraces on Tokyo CPI: Bulls Eye 95.00 Target as Support Holds

NZDJPY Retraces on Tokyo CPI: Bulls Eye 95.00 Target as Support Holds  FxWirePro: GBP/AUD key support held, downside risk remains

FxWirePro: GBP/AUD key support held, downside risk remains  FxWirePro: USD/ZAR edges higher but bearish outlook persists

FxWirePro: USD/ZAR edges higher but bearish outlook persists  FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook

FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook