European Central Bank (ECB) President Mario Draghi is scheduled to speak in Brussels before Committee on Economic and Monetary affairs (ECON) of European parliament at 13:00 GMT or 15:00 CET.

Market will be focusing on the following -

- ECB's assessment of future economic path in Euro zone

- ECB's assessment on inflation and if anything material has changed from last monetary policy statement.

- ECB's assessment over impact of China's slowdown in Euro zone. Greater the potential impact, higher the chances of further stimulus.

- Recent slowdown in Euro zone's growth momentum.

- Further hints over next monetary policy moves, though Draghi isn't expected to provide anything explicit.

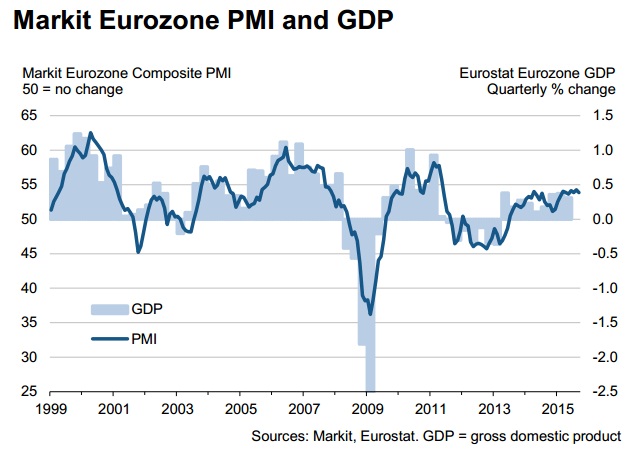

Today's PMI report from Markit economics showed that Euro zone is losing some steam.

- Euro Zone PMI composite output index dropped to 2 month low at 53.9 in September compared to 54.3 in August.

- Euro Zone headline services PMI dropped to 2 month low at 54 in September, compared to 54.4 in September.

- Manufacturing PMI dropped to 5 month low to 52 in September, compared to 52.3 in August.

- Though employment rose for 11th consecutive month, pace of job creation has fallen to 8 month low.

- However increased purchase of raw materials at fastest pace since February and backlogs at highest in three years, further growth is expected.

Euro is marginally up today, trading at 1.114 against Dollar.

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom