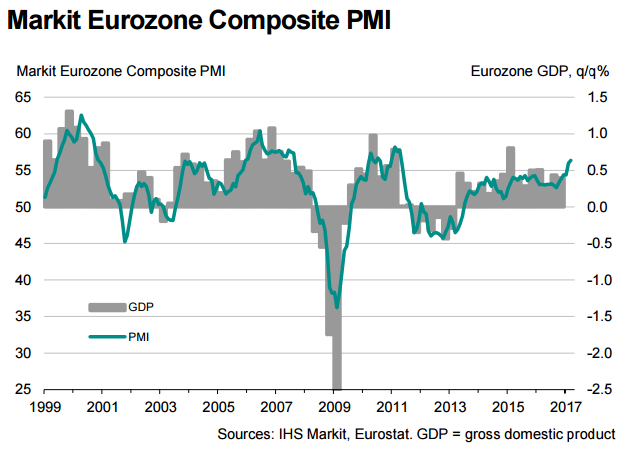

The eurozone final services and composite PMI data came below expectations. The final Markit Euro-zone PMI services sector index rose to a 70-month high of 56.0 in March, up from 55.5 in February but below the earlier flash estimate of 56.5. The composite index came in at 56.4 compared to a reading of 56.7 expected.

Breakdown showed that German services and composite PMIs came in close to expectations at 55.6 and 57.1, respectively, while French services and composite were softer than expected and came in at 57.5 and 56.8, respectively. Spain was close to expectations, while Italy was weaker than expected at 52.9 and 54.2, respectively.

The upturn in eurozone service sector output gathered momentum towards the close of Q1. Business optimism rose to a fresh series-record high, improving at service providers and remaining relatively elevated at manufacturers too. Price increases accelerated in Germany, Spain and Ireland. There were still price declines in France and Italy even though the pace of decline fell significantly.

The data overall will maintain expectations of strengthening growth conditions. However, there will also be further doubts whether the European Central Bank (ECB) will be confident enough to make any early move towards policy normalisation. At its March’s policy meeting, the ECB reiterated that a widespread rise in inflation is needed to be seen in order to trigger a tightening of monetary policy and the weak inflation pressures in both France and Italy will remain an important concern for the central bank.

“Price pressures remain elevated, and look likely to feed through to higher consumer prices in coming months, but it seems likely that the ECB will hold its accommodative policy stance until at least later this year. These survey numbers nevertheless shorten the odds of policy being tapered in early-2018,” said Chris Williamson, Chief Business Economist at IHS Markit.

In an interview published in a German national weekly newspaper, Die Zeit, Deutsche Bundesbank President Jens Weidmann was noted saying that the time to ease up on bond purchases is nearing and would welcome it if bond purchases are stopped within a year. Data for the second quarter will be closely watched given that the June ECB meeting could be a pivotal point for monetary policy.

EUR/USD was trading in a narrow range, at around 1.0677, at the time of writing. The pair has held strong trendline support at 1.0635 on Tuesday's trade. We find a hammer formation at Tuesday's lows. We see weakness on break below support at 1.0650. Downside till 1.0575 then looks likely.

FxWirePro's Hourly EUR Spot Index was at 44.0819 (Neutral), while Hourly USD Spot Index was at -30.4626 (Neutral) at 1215 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals