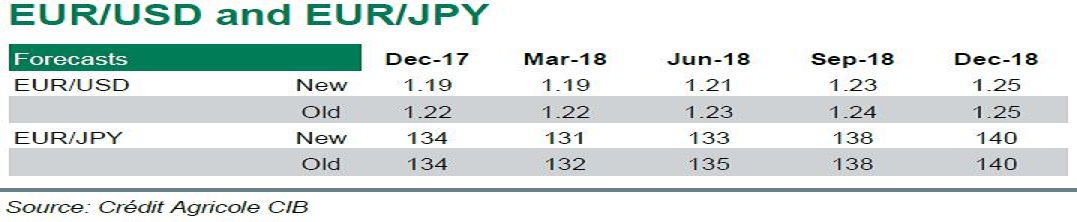

The EUR/USD currency pair is expected to gradually appreciate towards the 1.25-1.26 level by the end of 2018, according to a recent report by Credit Agricole CIB. That said, risks for the pair remain tilted to the upside over the medium to long-term. Indeed, with the ECB meeting out of the way, investors will now start to focus on the improving data coming out of the Eurozone.

On the USD-side, some positives from US President Donald Trump’s fiscal stimulus seem to be in the price. Coupled with the still dovish ECB forward guidance, this should keep the EUR-USD 2Y rate spread close to multi-year lows. At the same time, a gradual drift higher of EGB yields that are expected to be seen over the coming months should erode the attractiveness of UST investments for Eurozone investors.

In all, further unwinding of EUR-funded policy divergence trades is expected from now on. Combined with continuing inflows into the Eurozone equity markets, this should prop up EUR going forward.

"We continue to expect EUR/USD to appreciate gradually towards its long-term fair value of 1.25-1.26 by the end of 2018. Coupled with our relatively balanced outlook for USD/JPY, we also expect EUR/JPY to remain on an uptrend from now on, heading to 140 in Q418," the report said.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed