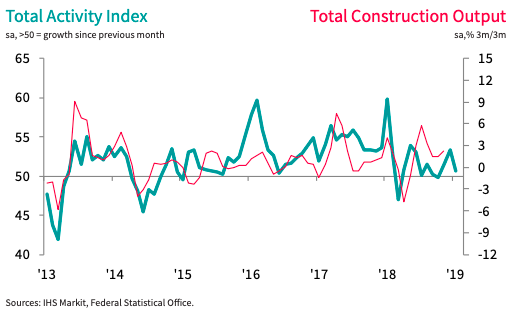

The EUR/USD currency pair suffered only marginally during the afternoon session Wednesday after Germany’s construction PMI slipped to 50.7 during the month of January, from 53.3 in December, largely owing to the renewed decline in commercial activity, which fell to the greatest extent in almost six years following modest growth in November and December.

New order growth was robust but also eased, as did the rates of increase in employment and constructors' buying levels. Despite the slowdown, constructors remained confident about the prospect of activity rising in the next 12 months.

On the cost front, constructors faced steep and accelerated rises in both sub-contractor rates and average purchase prices, with the latter reportedly driven up by increased energy costs and road toll charges. In addition, housing activity increased at a much slower rate than in December.

Civil engineering was the only area of construction that began the year on a stronger footing, recording a rise in activity for the first time in three months. German constructors recorded a further increase in lead-times on purchased items in January.

Though still substantial by historic standards, the deterioration in vendor performance was the least marked since April last year.

Looking ahead, constructors reported optimism towards the outlook for activity over the next 12 months, citing backlogs of work and hopes for new projects. The degree of confidence was at a six-month high, although well below the record levels seen in early-2018.

"Trying to unravel these distortions is difficult, but if we look at three-month moving averages to try to smooth fluctuations caused by any potential weather effects, then we see that the trend rates of growth for total activity, new orders and employment have all improved, albeit remaining below the highs in 2018. Alongside a rise in business confidence, this paints a fairly positive picture," said Phil Smith, Principal Economist at IHS Markit.

Meanwhile, at the time of writing, EUR/USD traded 0.14 percent lower at 1.1388.

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility