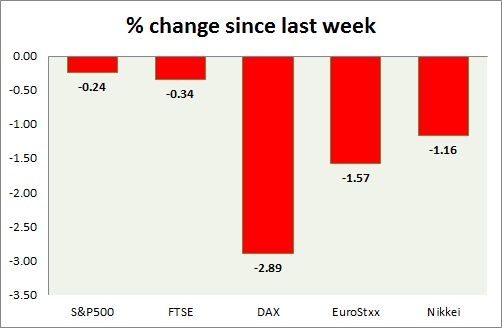

Equities faltered across globe as stronger dollar and increased prospect of a rate hike in US fuelled Global risk aversion. Performance this week at a glance in chart & table -

- S&P 500 - US benchmark is continuing its loosing spree after key support got broken. NFIB business condition improved in February to 98. JOLTS job openings fell below 5 million. Redbook index improved by 1% mom. S&P 500 is currently trading at 2055. Further losses can't be ruled out as key support is broken. Immediate support lies at 2040 and resistance 2081, 2103.

- FTSE - FTSE continues to lose further ground after it broke below two key support levels. BOE governor Mark Carney maintained his view of rate hike as the next policy move. FTSE is trading at 6749. Support lies at 6720, 6630 and resistance near 6860, 6965.

- DAX - DAX, star performer failed to gain further ground amid global risk aversion and selloff in equities however maintaining the gains made so far. DAX is currently trading at 11530. Immediate support lies at 11180.

- EuroStxx50 - Stock performance is mixed across Europe. Germany is down (-1.00%), France's CAC40 is down (- 0.56%), and Italy's FTSE MIB is down (-0.75%) whereas Spain's IBEX is down (- 1.10%). EuroStxx is currently trading at 3576, down -0.80% for the day. Support lies at 3540. Support at 3490 is much stronger.

- Nikkei - Nikkei gave in to risk aversion as Yen recovered over safe haven bids. The index is trading at 18570. Nikkei broke to 18488 in intraday trading but bounce back sharply from the support broken. Losses could exacerbate if key supports are broken. Immediate support lies at 18500, 18390 and resistance at 19000.

|

S&P500 |

-0.82% |

|

FTSE |

-1.92% |

|

DAX |

0.09% |

|

EuroStxx |

-0.75% |

|

Nikkei |

-1.51% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?