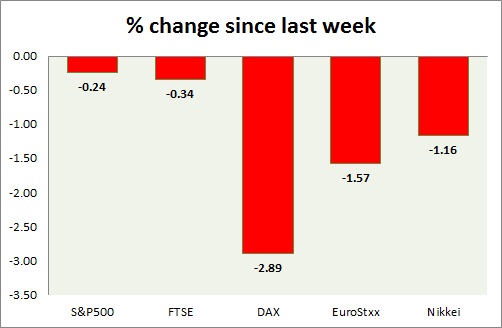

Equities are recovering some ground in today's trading as risk aversion subsided. Performance this week at a glance in chart & table -

- S&P 500 - US benchmark so far successfully bounce back from key support zone. US GDP for fourth quarter grew at an annual pace of 2.2%, lower than what was expected. Michigan Confidence came at 93 compared to prior 95. SPX500 is currently trading at 2059, up 0.10% for the day. Immediate support lies at 1980, 2040 and resistance 2120, 2164.

- FTSE - FTSE gave up gains further, as BOE official maintained hawkish stance. Further losses might be on card as key support level remains broken. Support lies at 6700, 6300.

- DAX - DAX shredding some of the losses of this week. DAX is currently trading at 11900, further losses might be on card for next week. Immediate support lies at 11600, 11390 and resistance at 12080.

- EuroStxx50 - Stocks across Europe are positive today. Germany is up (+0.41%), France's CAC40 is up (+0.76%), Italy's FTSE MIB is up (+0.50%) and Spain's IBEX is up (+0.18%). EuroStxx50 is currently trading at 3687, up +0.40% today. Support lies at 3635, 3545.

- Nikkei - Nikkei is worst performer today, trading around 19300 level. Price traded close to 19000 intraday. Immediate support lies at 19220, 18540.

|

S&P500 |

-2.37% |

|

FTSE |

-2.39% |

|

DAX |

-1.20% |

|

EuroStxx50 |

-1.05% |

|

Nikkei |

-1.88% |

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings