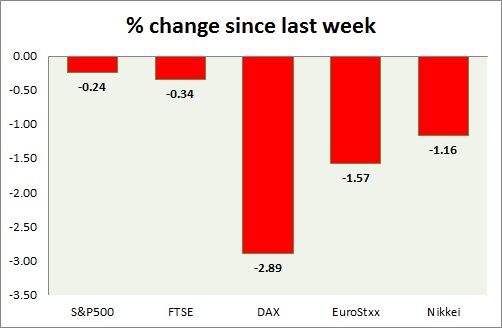

Equities are mixed today. Shredding some of the gains before FOMC minutes. Performance this week at a glance in chart & table -

S&P 500 -

- US benchmark is trading flat today, treading water around resistance area of 2080. Price is forming mild bearish long shadow candles in daily chart.

- MBA mortgage applications rose for consecutive third week, however this week's gain is marginal at 0.4%.

- SPX500 is currently trading at 2076, flat for the day, waiting for FOMC minutes to be released around 18:00 GMT. Immediate support lies at 1980, 2040 and resistance 2120, 2164. 2100 is expected to provide psychological resistance.

FTSE -

- FTSE gave up gains after trading above 7000 level, however that move could have been boosted by M&A activity between Shell and BG.

- FTSE is currently trading at 6936, down 0.35% today. Immediate support lies at 6700 and resistance at 9665 and 7060.

DAX -

- DAX has moved to red today, over profit booking after yesterday's massive gain. It might move to new highs over coming week.

- German factory orders shrunk in February by -0.9% m/m and -1.3% y/y.

- Index is trading at 12037, down nearly 0.70% today. Immediate support lies at 11830, 11750, and resistance at 12200.

EuroStxx50 -

- Stocks across Europe are all mixed today as market awaits clarification from FOMC minutes.

- French trade balance narrowed to € -3.45 billion.

- Germany is down (-0.6%), France's CAC40 is down (-0.32%), Italy's FTSE MIB is down (-0.65%) and Spain's IBEX is down (-0.75%).

- EuroStxx50 is currently trading at 3741, down 0.35% today. Broader trend remains upwards. Support lies at 3635, 3545.

Nikkei -

- Nikkei is the best performer this week, trading in green today. Weaker yen is providing support after BOJ kept policy steady.

- Nikkei is currently trading at 19843. Immediate support lies at 19000, 18540 and resistance at 19920.

|

S&P500 |

+1.61% |

|

FTSE |

+1.37% |

|

DAX |

+0.48% |

|

EuroStxx50 |

+0.65% |

|

Nikkei |

+2.68% |

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate