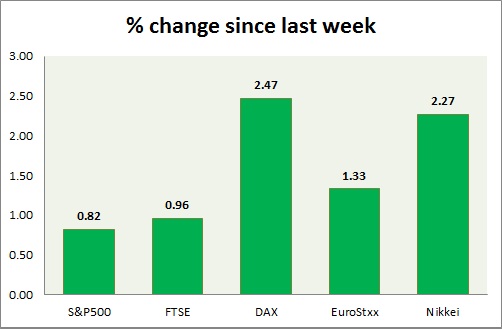

Equities are all trading in green today, boosted by global risk on sentiment. Performance this week at a glance in chart & table -

S&P 500 -

- US benchmark gained over 2100 level, however marginally up today.

- Redbook index grew at slower pace of 0.1% m/m and 0.8%.

- Philadelphia FED non-manufacturing activity index came at 41 in April against 48 in March.

- S&P 500 is currently trading at 2102, up +0.22% today. Immediate support lies at 1980, 2040 and resistance 2120, 2164.

FTSE -

- FTSE gained further grounds lost last week in today's trading. Bulls might test 7100 level once more trying to break out.

- Important support lies at 6950, 6700 and resistance around 7100 level.

DAX -

- DAX is giving up gains after bulls were halted close to old resistance level of 12080, however major trend remains bullish.

- In the short run though bulls might struggle as last week's candle was bearish engulfing.

- Index is trading at 11960, up nearly 0.6% today. Immediate support lies at 11600, 11200 and resistance at 12100, 12180, 12360.

EuroStxx50 -

- Stocks across Europe are mostly green, however bulls are seen struggling so far this week.

- Germany is up (+0.6%), France's CAC40 is up (+0.3%), Italy's FTSE MIB is down (-0.37%) and Spain's IBEX is up (+0.4%).

- EuroStxx50 is currently trading at 3720, up +0.35% today. Index might drop lower in short term. Support lies at 3635, 3545, 3300

Nikkei -

- Nikkei bulls marched beyond 20000 level making Nikkei the best performer this today. Further gains might be on radar. However risks of global sell off is high.

- Nikkei is currently trading at 20010. Immediate support lies at 19450, 18540 and resistance at 20800.

|

S&P500 |

+0.82% |

|

FTSE |

+0.96% |

|

DAX |

+2.47% |

|

EuroStxx50 |

+1.33% |

|

Nikkei |

+2.27% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings