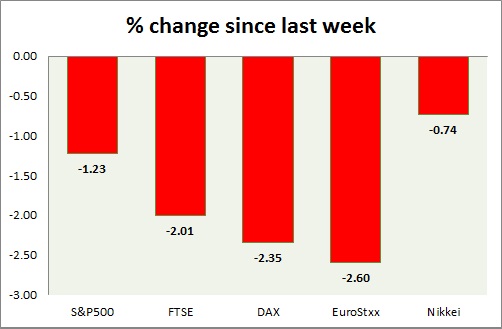

Equities are having bad day today hit by sell off across globe. Performance this week at a glance in chart & table -

S&P 500 -

- S&P once again failed to break in to new highs, hit by global selloffs. 2080 area provided interim support hating sell offs. Today's move has not generated any risk aversion move as yen remains relatively stable.

- Further sell off is likely, heavy swings might generate mass risk aversion sentiment.

- S&P 500 is currently trading at 2087. Immediate support lies at 1980, 2040 and resistance 2125, 2164.

FTSE -

- FTSE lost more than 1.5% today as global sell offs hit UK.

- Industrial production grew 0.7% y/y in March and manufacturing production rose 1.1% for same period.

- NISER GDP estimate was lower at 0.4%compared to prior 0.6%.

- FTSE is currently trading at 691. Immediate support lies at 6850, 6700 and resistance at 7120.

DAX -

- DAX is trading in red today, as rising bund yield continue to spook market.

- Larger trend remains upwards, however bears remain in control in shorter term. Bearish engulfing in weekly chart provided the necessary strength to bears. Target coming around 10550, should resistance at 11750 holds.

- DAX is currently trading at 11437. Immediate support lies at 10550 and resistance at 11750, 12080 around.

EuroStxx50 -

- Stocks across Europe are all trading in red today hit by rising yields.

- Germany is down (-2%), France's CAC40 is down (-1.35%), Italy's FTSE MIB is down (-1.41%) and Spain's IBEX is down (-1.5%).

- EuroStxx50 is currently trading at 3557, down -1.5% today. Support lies at 3450, 3300 and resistance at 3760

Nikkei -

- Nikkei is holding relatively well amid global sell off. Futures dropped further after cash market closed.

- With extreme one side position Nikki might go for larger correction.

- Nikkei is currently trading at 19503, further downside is likely should resistance 19750 holds. Price target is coming close to 17800.

- Key support is at 18900, 18400 and resistance at 19750 area.

|

S&P500 |

-1.23% |

|

FTSE |

-2.01% |

|

DAX |

-2.35% |

|

EuroStxx50 |

-2.60% |

|

Nikkei |

-0.74% |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings