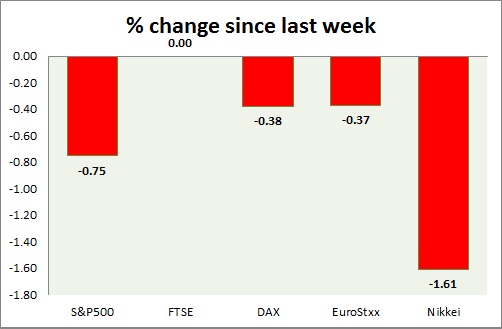

Equities are again trading in red today. Performance this week at a glance in chart & table.

S&P 500

- S&P future is down as risk aversion hits market hard over slowdown in China. Today's range 1970-1916.

- ISM manufacturing PMI dropped to 51.5 in August.

- TIPP economic optimism for September dropped to 42 from 46.9 prior

- S&P 500 is currently trading at 1934. Immediate support lies at 1900 and resistance 1960.

FTSE -

- FTSE opened in deep negative as index was closed over holiday yesterday. Today's range 6250-6025.

- FTSE is currently trading at 6050. Immediate support lies at 5950 and resistance 6600.

DAX -

- DAX is sharply down today, as risk aversion over China hits again. Today's range 9930-10240.

- DAX is currently trading at 10010. Immediate support lies at, 9750 area and resistance at 10500 around.

EuroStxx50 -

- Stocks across Europe are trading in red today.

- Germany is down (-2.5%), France's CAC40 is down (-2.60%), Italy's FTSE MIB is down (-2.25%), Portugal's PSI 20 is down (-2.65%), Spain's IBEX is down (-2.85%).

- Euro zone unemployment rate dropped to 10.9%, lowest in more than 3 years.

- EuroStxx50 is currently trading at 3190, down by -2.25% today. Support lies at 3000 and resistance at 3300.

Nikkei -

- Nikkei is worst performer this week as stronger Yen is providing headwinds. Today's range 18470-19070.

- Nikkei is currently trading at 18040, with support around 16000 and resistance at 19500.

S&P500

-2.86%

FTSE

-2.97%

DAX

-2.71%

EuroStxx50

-2.80%

Nikkei

-5.84%

Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight

Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight  BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K  The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’

The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’  The strikes on Iran show why quitting oil is more important than ever

The strikes on Iran show why quitting oil is more important than ever  Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes

Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes  Crude Oil on the Cusp: Hormuz Blockade Threats Fuel 15% Rally Toward USD 85 Target

Crude Oil on the Cusp: Hormuz Blockade Threats Fuel 15% Rally Toward USD 85 Target  Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000

Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000  Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play

Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play