Euro Zone, as well as, the European Union is facing one of the most diverse economic and Labour market recoveries in the history. Partial reforms pursued by governments coupled with the ultra-easy monetary policy from European Central Bank (ECB) has led to the rise in employment across Euro Zone, however, any level that can be called as normal still remains far off.

As of now, inflation is low with thanks to lower oil price, however if inflation do return before fragmentation is removed ECB would face critical policy choices, whether to raise rates to prevent any overheating of stronger economies with lower unemployment rate or to keep easing to bolster growth across the weaker ones like Greece, Spain, Cyprus.

European Central Banks (ECB) and the governments need to coordinate together to pursue reforms in such a way that economic recoveries converge and fragmentation gets reduced.

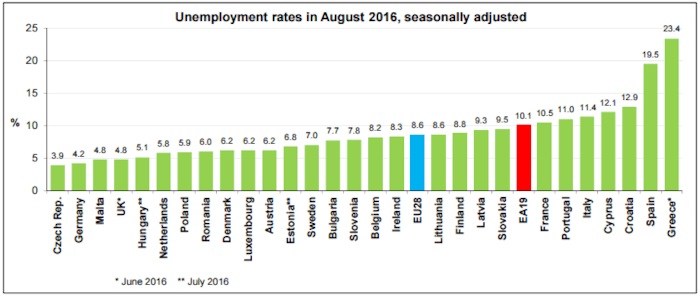

As of latest employment report fragmentation still high, despite improvement in the overall labour market –

- Euro area unemployment rate is at 10.1 percent in August, which is five-year low. However, a lot is still to be done as more than 15 million still remains unemployed in Euro area.

- Fragmentation is quite large. While Germany enjoys lowest unemployment rate in the region at 4.2 percent, Greece and Spain have their rates at 23.4 percent and at 19.5 percent.

- Even in France, every one in ten is unemployed.

- Euro area’s third largest economy, Italy is suffering unemployment as high as 11.4 percent.

In recent days, ECB has been struggling with its monetary policies; record easing and negative rates, still not pushing inflation higher. It’s time the governments do step in.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals